Ready to embark on your investment journey but unsure where to begin? Dive deep into our comprehensive guide tailored for beginners, and unveil the strategies to amplify your financial growth.

Taking the first steps in investing can be both exhilarating and daunting.

This guide is designed as your introduction to investing, offering a roadmap for those at the beginning of their investment journey.

From understanding the basics to making informed decisions, I’m here to help you get started with confidence.

When I was taking my own first steps in investing, these were the questions and doubts that clouded my mind

How do I get started?

What do I choose?

Where do I look?

While it’s true that mastering the intricacies of investing isn’t an overnight task, the journey becomes much smoother once you understand its core principles. And trust me, it’s far less intimidating than it first appears.

The goal of this article is simple: to demystify the complexities surrounding investing and share insights (from a non-financial advice perspective) on easing into the investment world, one step at a time.

To structure our exploration, I’ll focus on two foundational pillars of investing:.

- Understanding the power of investing, the ‘why’ behind investing

- Cultivating the mindset and habits of a successful investor, the ‘how’ behind investing

I’ll also touch upon some platforms that were instrumental in kickstarting my investment journey. They’re user-friendly and perfectly encapsulate the principles we’ll discuss.

Do note, however, that since I’m based in Australia, some platforms might cater specifically to Australian investors. But rest assured, the core lessons and insights in this guide are universal.

So, let’s embark on this exciting journey into the world of investing!

Why Invest? Understanding the Power of Investing

The Motivation Behind Investing

There are many different ways to invest your money and just as many reasons why people choose to invest in the first place.

For the sake of this article, we will focus on investments in shares and the stock market since this is perhaps the most common, or at least a well-known, investing method.

One of the primary motivations behind investing in shares is the allure of financial growth.

As companies innovate, expand, and increase their profitability, the value of their shares often rises.

This capital appreciation means that over time, the stocks you buy could be worth significantly more than their purchase price.

By strategically selecting and holding onto shares from companies with strong growth potential, you have the opportunity to accumulate substantial wealth, making investing a key component your long-term financial plans.

Shaping Your Future

We all have different goals, hopes and desires, so you should look at investing as a tool that can help shape your life trajectory into the kind of future that you want.

What one person views as an ideal future, could be starkly different to what someone else considers an ideal future, so it’s important to map out what it is that really brings the most amount of joy and happiness into your life — then look at your investments as fuel to maximising whatever it is that may be.

For some, this could be something simple like achieving a specific goal — such as buying a new car, a new house, or having enough money for retirement.

For others, an ideal future may mean having greater flexibility in life. For example, if you’re earning a regular income from your investments, you could potentially afford to spend less time working, and more time on your hobbies or with your friends and family.

You could have more flexibility over where you choose to live, greater opportunity to support causes you care about, or start a business … the list goes on!

This is arguably the most powerful thing about investing — the ability to give you more time to focus on the things you love doing.

The Compound Effect: Maximizing Returns Over Time

One of the most compelling reasons to start investing is the power of compound interest.

The beauty of compound interest lies in its simplicity.

Imagine planting a tree and watching it grow. Not only does the tree grow, but it also bears fruits, which in turn seed more trees.

Similarly, with compound interest, it’s not just your initial investment that grows, but also the returns on that investment.

Starting early and consistently investing, even in small amounts, can lead to exponential growth over time, turning modest contributions into significant wealth.

In its most simplest form, investing is essentially making your money work for you to make more money.

"You can make a lot more money a lot faster by sending your money to work for you every day, rather than just sending yourself to work every day."

Warren Buffett Tweet

Building Wealth Through Diversification

In the world of investing, diversification is your safety net.

Instead of concentrating your funds in a single stock or sector, spreading your investments across various industries and companies can mitigate risks.

Different sectors react differently to economic changes, and while one industry might be facing challenges, another could be thriving.

By diversifying your stock portfolio, you ensure that potential downturns in one sector might be offset by gains in another, leading to a more balanced and resilient investment strategy.

Income Through Dividends

Beyond the potential for capital gains, many publicly traded companies reward their shareholders by distributing a portion of their profits in the form of dividends.

These regular payouts can serve as a consistent income stream, especially appealing to those looking for passive income opportunities.

Over time, reinvesting these dividends can lead to compound growth, further amplifying the benefits of stock investing.

Beating Inflation

Inflation, the gradual increase in prices over time, can erode the real value of money.

Simply saving money might seem safe, but when inflation rates surpass savings account interest rates, the real-world purchasing power of that saved money diminishes.

Investing in shares offers the potential for returns that not only match but often exceed inflation rates.

This ensures that your hard-earned money grows in real terms, preserving—and ideally enhancing—its purchasing power.

Building Financial Security

Investing in the stock market is more than just seeking profits; it’s about building a foundation for financial security.

A well-diversified portfolio of shares can serve as a financial safety net, providing resources for future needs.

Whether you’re planning for retirement, preparing for unforeseen emergencies, or saving for significant future expenses like a child’s education, investments in shares can be a cornerstone of financial stability and peace of mind.

Participating in Economic Growth

When you invest in shares, you’re buying a stake in a company and, by extension, a piece of the broader economy.

As sectors and industries flourish, companies within them often see growth in their stock value.

Investing allows individuals to tap into this economic growth, benefiting directly from the successes of industries and the broader market.

It’s a way to align personal financial growth with the expansion and innovation of the business world.

Legacy Building: Leaving a Lasting Impact

For many, investing isn’t just about personal gain or immediate financial goals. It’s about creating a lasting legacy that can benefit future generations.

By strategically investing and growing wealth over time, individuals can ensure that they leave behind a substantial financial foundation for their loved ones. This can mean:

Educational Opportunities: Setting up funds to ensure children, grandchildren, or even great-grandchildren have access to quality education without the burden of student loans.

Philanthropic Endeavors: Amplifying charitable contributions by investing and then donating the returns or principal amounts to causes close to one’s heart. This approach can make a significant difference, whether it’s supporting medical research, environmental causes, or community projects.

Estate Planning: Properly managed investments can be a cornerstone of estate planning, ensuring that assets are distributed according to one’s wishes and providing financial security for heirs.

Business Continuity: For those who own businesses, investing can provide the necessary capital to ensure the company thrives beyond their tenure, benefiting employees and the community.

Cultural and Community Contributions: Investments can fund projects that enrich the community or support cultural endeavors, from building community centers to sponsoring local arts programs.

By viewing investing through the lens of legacy building, it becomes more than just a financial strategy. It transforms into a powerful tool for long-term impact, ensuring that one’s contributions resonate for years, if not decades, to come.

How to Invest? Establishing the Habits of an Investor

The Myth of Overnight Success

When diving into the world of investment basics, many harbor dreams of amassing wealth overnight.

However, the true essence of investing lies not in instant gratification but in understanding the long game.

Successful investing is less about immediate riches and more about patience, strategy, and understanding market dynamics.

Time and Consistency: Your Best Allies

In the realm of financial planning for beginners, the real challenge is to maintain consistent investments over extended periods.

While market fluctuations are inevitable, maintaining regular investments—even during downturns—can lead to substantial growth over time.

The power of compounding, a fundamental concept for those new to the stock market, can transform even modest, regular contributions into a sizeable nest egg.

The Magic of Compounding

Most people often fail to realise how quickly they can develop a sizeable investment account simply by making modest but regular investments and letting the magic of compounding perform its miracle.

I have written about compounding interest and how powerful it is in a previous article of mine.

Let’s say you open an investment account and deposit an initial $5,000 investment and leave it there for 10 years, no further deposits, no withdrawals, completely untouched. Historically, the stock market achieves an annual return of 8–10% . So assuming we earn an annual return of 8% on our initial $5,000 investment, after 10 years, the value of your investment account would be $10,795. That’s more than double your initial investment, not a bad performance!

But now let’s consider what would have happened if you had just made one ever-so small adjustment.

Instead of only depositing your initial $5,000 investment, you instead contribute an additional $50 every month into your account. Now if we look at the performance of your investment account (still only assuming an annual return of 8%), after 10 years, the value of your account would be $19,487 — that’s almost double the account size that you’d have had without making any additional contributions.

If you follow this approach again but instead increase those monthly contributions up to $100 per month (instead of $50), then the 10-year account total would jump to over $28,178…and all from an initial investment of just $5,000, supplemented by very modest additional contributions on a regular basis.

This just shows you the power of regular investments and its compounding effect over many years.

Starting Small: The Micro-Investing Approach

Not all of us have $5,000 that we can just casually throw into the stock market.

Nor would you be comfortable doing so if you were only just starting out on your investment journey.

Diving headfirst into the stock market can be intimidating for beginners.

That’s where micro-investing comes in.

Micro-investing offers a solution, allowing you to invest small amounts regularly, making the investment journey more accessible.

It’s an excellent introduction if you’re looking to diversify their portfolio on a budget and offers a practical approach to setting financial goals without hefty upfront costs.

We will talk more about micro-investing in a minute, but first, let’s address some common investing misconceptions.

Demystifying Common Misconceptions

When I first dipped my toes into the world of investing, I was bombarded with a plethora of myths and misconceptions. Maybe you’ve heard some of them too. “Investing is just for the wealthy.” “It’s too risky for ordinary folks like us.” “You need to be a financial whiz to get started.” Sound familiar?

Let’s set the record straight and debunk some of these common misconceptions:

"Investing Requires a Lot of Money"

"It's Too Risky"

"You Need to Be a Financial Expert"

"The Stock Market is Like Gambling"

"It's Too Late for Me to Start"

By understanding and debunking these misconceptions, we can remove the barriers that often hold us back.

Investing is a journey, and like any journey, the first step is often the hardest. But with the right mindset and knowledge, you and I can navigate the investment landscape with confidence.

Micro-Investing: Breaking Down Investment Barriers

Starting your investment journey can be intimidating, especially when faced with high initial costs.

Traditional brokerage platforms, especially in Australia, often demand substantial minimum investments.

For instance, renowned stock brokerage companies like CommSec, SelfWealth, and CMC typically ask for a minimum of $500 for your first stock investment.

Enter Micro-Investing

Micro-investing offers a solution to this barrier. As the name suggests, it’s about making small, often automated, investments. Managed primarily through user-friendly apps, micro-investing platforms remove the hefty initial deposit requirement. They introduce features like:

- Recurring Investments: Set and forget a specific amount to invest regularly.

- Lump Sum Deposits: Add funds whenever you have some spare cash.

- Round-Up Purchases: Turn your everyday purchases into investments. For instance, a $4.50 coffee purchase gets rounded up to $5, with the 50 cents difference invested.

Imagine the accumulation over time! Your frequent small transactions, combined with market performance, can lead to a surprising investment portfolio growth.

Understanding the Micro-Investing Model

However, it’s essential to note that some micro-investing platforms limit you to investing in exchange-traded funds (ETFs) or specific portfolios.

We will cover ETFs in the next part of this guide, but basically – Instead of buying stocks from individual companies, you’re purchasing a diversified mix from several entities.

While this might seem restrictive, it’s a boon for beginners. Diversification inherently reduces investment risk, spreading your funds across various sectors and companies.

Building Investment Habits

One of the most significant advantages of micro-investing is the habit it instills.

Regularly setting aside even small amounts can lead to substantial long-term growth.

Once you witness the ease and benefits of consistent investing, it’s likely to become a lifelong practice, fortifying your financial future.

User-Friendly Platforms

The convenience of micro-investing is unparalleled. With intuitive apps, setting up and managing your investments becomes a breeze, allowing you to start your investment journey from the comfort of your smartphone.

Even though there are cheaper alternatives to micro-investing, it helps to drive wider adoption. If you’re a beginner to the investing world, you want simplicity and ease of use.

That’s what’s these apps are designed to do.

That’s why I advocate for these platforms for beginner investors.

A Caution on Fees

Although micro-investing apps don’t charge brokerage fees each time you make a trade like traditional broker accounts do, they do still need to earn a profit from somewhere.

Typically, this comes from either paying a monthly subscription fee or in the form of a transaction fee applied to each trade.

In fact, it’s not uncommon to pay fees of 1% using these apps.

And sure, for lower amounts, this transaction fee may seem tiny, but if you were to scale up your investments, then a fee of 1% quickly adds up.

Don’t believe me? Let’s look at an example.

Let’s assume you invest $50,000 and leave it to grow over the next 40 years.

If we assume an average annual return of 7%, let’s see how a 1% fee impacts your investment.

Using the Investment Fee Calculator I created, a 7% annual return on a $50,000 investment would grow your investment to approximately $777,000 after 40 years.

However, with a 1% fee, your annual return is effectively reduced to 6%.

Using the same calculator, after 40 years, your investment would instead grow to approximately $534,000 if you were paying a 1% fee.

So that ‘small’ 1% fee would cost you $243,000 in this scenario!

In other words, that 1% fee decreases your total investment return by more than 31%.

Even a seemingly small fee can significantly impact your investment over the long term.

That’s why it’s crucial to understand the fees associated with any investment and to factor them into your investment strategy.

But honestly, by the time you were considering increasing your investments to the amounts I used in that example, I’m sure you would have developed a sufficient appetite for investing, at which point you may opt to transfer your balance from micro-investing platforms into more traditional brokerage accounts that you oversee yourself (more on this in part 3!).

Platforms to Kickstart Your Investment Journey

When I began my investment journey, I explored various micro-investing platforms to find the ones that best suited my needs. Here’s a brief overview of the ones I found most user-friendly and aligned with the principles we’ve discussed.

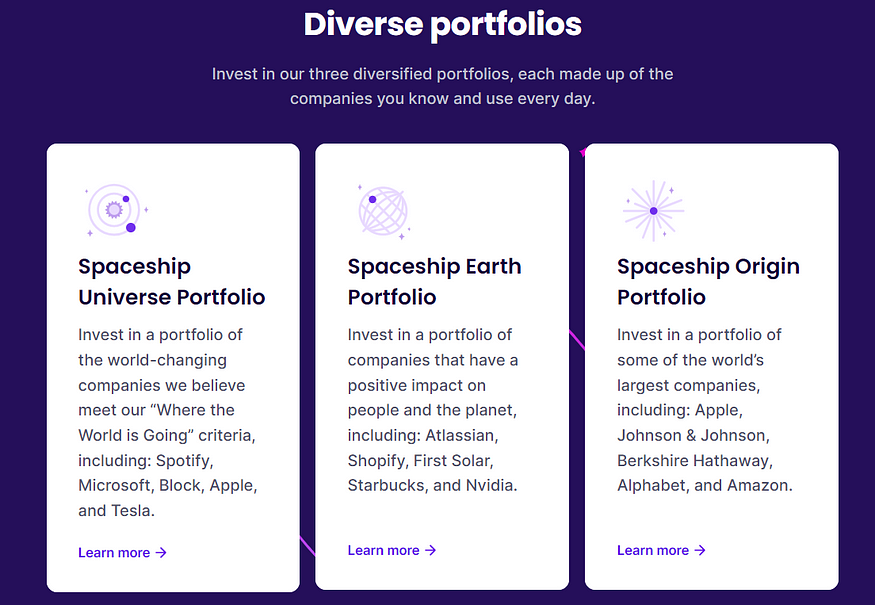

Spaceship

Spaceship is a micro-investing platform that has gained popularity in Australia over the past few years. It’s a mobile app that allows users to deposit lump sums or set up recurring weekly, fortnightly, or monthly payments into a choice of three diverse portfolios, giving you the option to choose a portfolio that aligns with your interests.

You can track the progress of your portfolio through the mobile app and link your portfolio to an external bank account to deposit and withdraw money.

Fees:

Spaceship is completely free for investment accounts with balances under $100 AUD. Once your account has exceeded that amount, you will be charged a flat monthly fee of $2.50 (AUD) to use their services. That’s irregardless of whether you hold $101 or $50,000 in your account. Because of this, Spaceship is one of the cheapest options out there…

In fact it is actually the micro-investment app I used the most when I was learning how to start investing.

Bonus Referal Reward

Because I have personally used Spaceship, if you register through this Spaceship link and sign up/enter using my code S8TB2GIJOK, you and I will both get a free $10 after you invest your first $5 in your chosen portfolio. That’s $10 added to your pocket just for depositing an initial $5 investment (remember, you wont be charged any fees until you have at least $100 in your account either). Plus you will gain experience in investing, that’s a win-win if you ask me!

Raiz

Raiz is another interesting micro-investing app that allows Australians to invest their ‘spare change’ into the financial markets in a fully autonomous manner.

Raiz has an ‘automatic round-up’ feature which allows you to invest your spare change without even thinking about it.

The platform allows you to round up any purchases made on your linked transaction account to the nearest dollar and invest your spare change.

That’s why I’ve included Raiz in this post, because it’s a great tool to teach you how to start investing with small amounts of money.

You have the option to invest in one of six different diversified portfolios of varying risk levels: conservative, moderately conservative, moderate, moderately aggressive and aggressive.

Raiz has added the ’emerald’ portfolio option for those interested in socially responsible investments.

On top of the default portfolios, Raiz does also give you the option to create a customised portfolio of your liking (for a higher fee). This allows you to build your own personalised portfolio out of a selection of ETFs and cryptocurrencies.

One feature I love about Raiz is that you can set up multiple portfolios and invest small amounts regularly for your children/grandchildren.

Raiz also provides setup guidelines to help each child manage their own account and gain important saving skills, and I am all about promoting financial literacy so this is a big positive in my eyes!

Fees:

Like Spaceship, Raiz charges a monthly subscription fee for use of their services, but the amount varies depending on whether you opt to use a default investment portfolio versus a custom portfolio. The fees for each option are:

Default Portolios: $3.50/month for accounts with under $15,000 or 0.275% of balance for accounts with >$15,000.

Custom Portfolio: $4.50/month for accounts with under $20,000 or 0.275% of balance for accounts with >$20,000.

Bonus Referal Reward

If Raiz does sound like it would be a good match for you, make sure to sign up through this Raiz link and use invite code 8L7F4A to land yourself and I a free $5!

Sharesies

Sharesies is the new kid on the block in the micro-investing world.

This platform revolutionizes the investment landscape by challenging the traditional view of investing, making it more accessible, user-friendly, and inclusive for individuals of all financial backgrounds.

I’ve written an entire review post about Sharesies, so I highly recommend you check it out!

A Note for International Readers

While platforms like Spaceship and Raiz are specific to Australia, the principles of micro-investing are universal. No matter where you are in the world, the core tenets of starting small, being consistent, and diversifying remain the same. Research local platforms in your region that offer similar services.

Conclusion & Next Steps - How To Start Investing

Your first steps to investing can be daunting, so I hope this post has helped shed some light on how you can get started.

Micro-investing platforms offer a gentle introduction, allowing you to start small and grow your confidence over time. As you progress, remember the importance of diversification and consistent contributions.

Did you find the idea of micro-investing exciting? If so, which platform do you think you will try?

Spaceship or Raiz?

Or if you live outside of Australia, will you be researching micro-investing options in your region? Let me know in the comments!

Before I leave you to get on with your day, I just wanted to say that one of the key aspects of learning how to start investing is understanding the importance of diversification.

That’s what the next part of this guide is all about, so be sure to check out part 3 of my complete beginners guide when you have the time!

Have a splendid day!

Cheers,

-Nate

Frequently Asked Questions (FAQ)

Micro-investing involves investing small amounts of money regularly, often using platforms that automate the process, making it accessible for everyone.

Yes, most platforms charge a fee, either as a monthly subscription or a percentage of the investment. Always check the fee structure before committing.

Typically, micro-investing platforms offer portfolios comprising multiple stocks, ensuring diversification. Some platforms might allow custom portfolios, but this could come with higher fees.

While micro-investing is beginner-friendly, even seasoned investors can benefit from the automated, consistent investment approach it offers.

Consider factors like fees, portfolio options, user interface, and customer reviews. It’s also essential to choose a platform aligned with your investment goals.

Pingback: My Motivations Behind Creating Trajectory To Wealth | Trajectory To Wealth

Pingback: Essential Things To Consider Before You Start Investing | Trajectory To Wealth