Learn the concept of compound interest and how it can be used to exponentially grow your savings. See it work in practise by using the free compound interest calculator I created.

Compound Interest Explained

Compound interest is the interest that is earned on:

- the initial deposit you make (known as the principal amount)

- the accumulated interest that is earned from previous periods

This is different to simple interest. With simple interest, the only interest you earn is on your principal amount.

To explain how these differ, I have constructed the table below to demonstrate the power of compounding interest and how it grows your savings exponentially faster than simple interest.

It grows at a much faster rate because rather than earning interest only on the principal amount ($10,000), compounding also earns interest on the interest that is earned in the previous periods.

For example, in year 2, your savings (with compound interest) earns interest on $11,000, and in year 5, you earn interest on the accumulated interest from years 1-5, and so on.

Whereas with simple interest – you only earn interest on the principal amount ($10,000) each year.

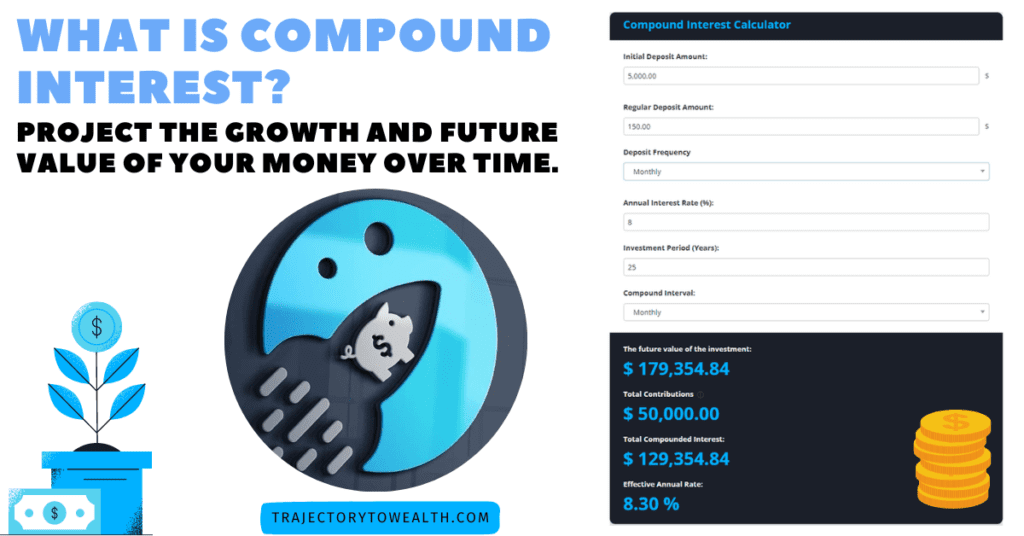

Project The Growth And Future Value Of Your Money Over Time.

I’ve created a compound interest calculator that you can use yourself to see how much you could save (see the calculator below).

It’s very easy to use!

The compound interest calculator helps you determine:

- how much you could earn by saving a regular amount

- how compounding increases your savings interest

- the difference between saving now and saving later

You start by entering your initial deposit amount. After that, you can then set a regular deposit amount and specify how often you will be making additional contributions.

Or if you just wanted to see the effects of compound interest on a one-off single deposit, just set the regular deposit amount to $0!

Once you’ve entered your deposits, you now need to specify the interest rate.

If you aren’t sure what a ‘realistic’ interest rate is, 8% is a good starting point. Typically the stock market returns on average 8-10% per annum, so 8% is a somewhat conservative representation of the results you could achieve if you were to invest in a no-fuss index fund that tracks the performance of the stock market.

After that, the only two fields left to fill in are the investment period and compound interval.

The investment period is pretty straightforward – it’s the amount of time (in years) that you want to assess the effects of compounding over. For example, if you enter 10, then the results will show you the amount of compound interest you could earn over a 10-year period for the specified deposit amounts you define.

The compound frequency represents how often your investments are compounded. I give you two options here – monthly or annually which is in line with standard industry practice. Basically if you select monthly, your investments will be compounded at the end of each month (12 times a year). And if you select annually, then they will be compounded once per year.

If you do choose a monthly compound interval, it will slightly increase the effective annual rate you receive (that’s because your investments are compounded more than once per year), so I’ve included this as an output for you to see. If you swap it back to annually, you’ll notice it matches exactly the annual interest rate you’ve specified.

Compound Interest Calculator – Glossary

Initial deposit: the initial amount deposited.

Regular deposit amount: the amount you use to contribute to your savings on a regular basis.

Deposit frequency: how often you deposit money (select from drop down list)

Annual interest rate: the percentage that the account pays you.

Investment period: the number of years in which you want to save.

Interest Compounds: the compounding frequency of interest money (select from drop down list).

Future investment value: the total amount of money, including initial deposit, interest and contributions.

Total contributions: the total amount you contributed to your savings after the initial deposit.

Total compounded interest: the total amount that the account paid you.

Calculator Assumptions/Disclaimer

Please be aware of the following assumptions and disclaimers when using my calculator:

Assumptions

- Your initial deposit is made today.

- All regular deposits are made at the end of the chosen deposit frequency (year, month, fortnight, week, or day).

- Interest may be credited either monthly or annually, in line with standard industry

practice This calculator does not account for inflation and income taxes

Disclaimer

- A model does not guarantee actual performance. Results are only indications, the actual results may be higher or lower.

- This calculator is not intended to be your sole source of information when making a financial decision. Consider seeking advice from a professional before making any financial decisions.

Disclaimer:

Investing always involves a level of risk. You aren’t guaranteed to make money, and it is possible to lose the money you start with. The author is not a financial advisor, so neither the author nor the publication takes any responsibility or liability for any investments, profits or losses you may incur as a result of this information. This content is intended for general informational and educational purposes only and may contain affiliate links. You should consider seeking independent legal, financial, taxation or other advice when considering whether an investment is appropriate for your objectives, financial situation or needs.

Pingback: Expense Tracker Spreadsheet And Budgeting Tool Template | Trajectory To Wealth

Pingback: Personal Finance Spreadsheet | Budgeting Tool Template