Before embarking on your crypto journey, it’s extremely important that you understand how to store and keep your digital assets safe from hackers and other malicious thieves in the crypto space.

When you purchase cryptocurrency, it is stored in a digital wallet. These digital wallets are different to a wallet that you carry around in person. Instead, a digital wallet is required not only to enable the storage of crypto but also to enable the sending and receiving of your crypto assets to other wallets on the blockchain. There are a number of different types of crypto wallets that exist. These range from complex security solutions to simple-to-use apps or software web plugins. The purpose of this article is to provide you with a summary of the various types of crypto wallets and the level of security tied to each.

Why Are Crypto Wallets Important?

Unlike a physical wallet that holds actual cash, crypto wallets technically don’t store your crypto. This is because your holdings live on the blockchain, and are instead accessed using a private key that gives you ownership over the funds that live on the blockchain. This is the whole purpose of a crypto wallet – to act as a mechanism that proves your ownership, which in doing so allows you to interact with digital assets (buy, swap and sell) on the blockchain. There are several types of cryptocurrency wallets with different layers of security. But regardless of the type of wallet you have (which I will describe shortly), all of them contain unique keys that enable the owner to unlock and access the funds inside. Since these keys are quite literally the key to accessing your crypto – If you lose your unique key, you lose access to your crypto assets. That’s why it’s important to understand the types of crypto wallets that exist, and how you can secure your assets with these.

Keeping Your Digital Assets Safe

All cryptocurrencies that exist on the blockchain are stored in a crypto wallet. As we now know, we use unique keys to access the funds associated with a specific wallet. There are two types of keys we need to understand which you get when you sign up for or create a crypto wallet. These consist of a public key and a private key.

- Public key: A public key is a cryptographic code that allows anyone to send transactions to your wallet, sort of like how you transfer funds to your friend’s bank account.

- Private key: A private key, on the other hand, is more similar to your bank PIN. This is the key required to access the assets within your wallet and should only ever be known by you personally – no one else.

On top of public and private keys, when you set up a crypto wallet, you also need to take note of something known as a seedphrase. The best example I can compare the seed phrase to are security questions that you may have used as a backup recovery method to your email or other social media accounts. However, a seedphrase is much more robust and secure since, unlike a security question which only requires a single worded answer, a seedphrase is a sentence consisting of a series of random combinations of words. This means that it is almost practically impossible for someone to guess your seedphrase. And this is important because whoever has access to your seedphrase – has access to your crypto. It’s therefore vital to write down your seed phrase and keep it locked away in a safe place. In fact, a seedphrase is so important that most people recommend not storing it digitally on your laptop or smart device since malicious hackers could access it if they gained access to your computer. Instead, it is safer to keep a physical written down copy that is secured away someplace safe.

Types Of Crypto Wallets

As I mentioned earlier, there are several types of crypto wallets that exist, each with a different security solution tied to them. Specifically, there are two categories of crypto wallets:

- Hot wallets

- Cold wallets

The difference between a hot and a cold wallet is basically whether the wallet is connected to the internet or not. Hot wallets are wallets that run on internet-connected devices like computers, phones, or tablets.

In contrast, a cold wallet is not connected to the internet. Instead, cold wallets store private keys on a physical medium which means it is harder for hackers to access because they are stored offline. This does however mean that they risk being lost or destroyed. But aside from this, cold wallets are considered to be a much safer option for storing cryptocurrency compared to hot wallets. This makes them suitable for storing long-term or large amounts of crypto investments.

Hot and cold wallets both come in different forms, from user-friendly mobile apps which make using crypto as easy as shopping online, to physical hardware products that look like a USB stick. The next section of this article will summarize the following types of wallets:

- Software Wallets (Hot wallet)

- Hardware Wallets (Cold wallet)

- Paper Wallet (Cold wallet)

Software wallets

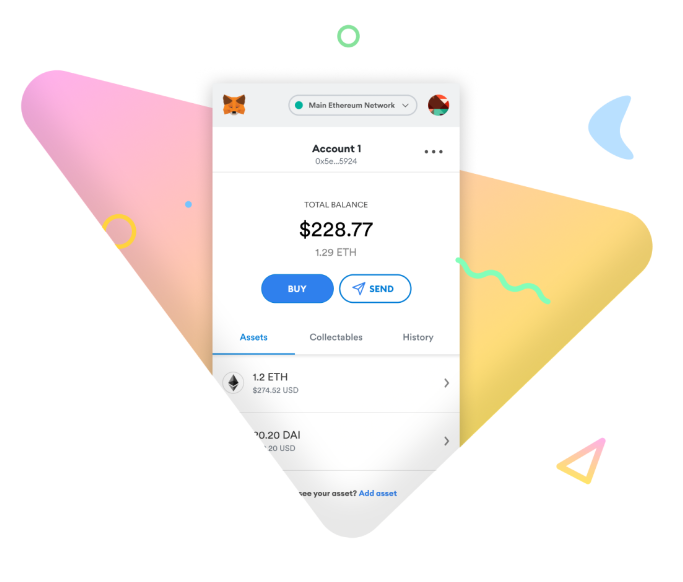

Software wallets or online wallets are perhaps the most used form of crypto wallets out there. These particular types of wallets are hot wallets since they are connected to the internet and the keys are stored in an app or software. The reason software wallets are common is that they provide a convenient and easy way for users to interact with a wide range of cryptocurrencies and blockchains. MetaMask is the most well-known and popular online wallet and is set up simply by downloading a plugin extension on a browser such as Google Chrome. Software wallets encompass desktop, web-plugin, mobile and most exchange custody wallets.

Although hot wallets are convenient and provide easy accessibility to your assets, your security against malicious users or hackers is limited to the protection offered by the wallet provider’s security – so features like two-factor authentication/verification are an important consideration for hot wallets.

To safeguard your assets, these hot wallets should only be used to store small amounts of cryptocurrency. Think of a hot wallet as your spending account, you use it to make purchases and transactions, but it is your savings account that holds the bulk of your assets. In this sense, a cold wallet could be likened to your savings account since it is much less prone to hacking and therefore safeguards our large crypto investments.

A Note On Exchange Custody Wallets

When you sign up with a cryptocurrency exchange such as Coinbase or Swyftx, any cryptocurrency you purchase through that exchange is stored on a hot wallet that is integrated with your online account. These wallets are called custodial accounts provided by the exchange. So although the hot wallet is integrated with your account, you are not actually the holder of the private key to the cryptocurrency that is held in this wallet – instead the exchange is the true holder. So basically, the crypto you hold in an exchange wallet is not the same as holding it in your personal hot wallet.

Hardware wallets

A hardware wallet consists of a physical thumb-drive device that stores your crypto keys offline. It is only connected to a computer when you want to approve a cryptocurrency transaction such as purchasing or sending crypto to another wallet. Hardware wallets often look like a USB stick. Essentially, they are a micro-computer with a couple of buttons that allow you to authorise and sign transactions before they occur. What this means is, that when you want to complete a transaction, such as sending your crypto, all you need to do is connect your hardware wallet to your computer. Once you initiate the transaction, eg. sending bitcoin to your friend, your hardware wallet will register the transaction and display a message on its screen. You then have the option to approve or decline the transaction, which can only be completed by clicking the buttons on the physical hardware wallet. This eliminates the ability for hackers to gain access to your wallet and approve transactions themselves, which is why cold-wallet storage is much more secure than hot-wallet storage.

One of the most popular hardware wallets out there is the ‘Ledger’ hardware wallet. This is the wallet I use to secure my own crypto assets, and to provide you with some more context, I have included an image below of a ledger device so you can see for yourself how similar to a USB stick it is.

Paper wallets

Another type of cold storage is paper wallets. These types of wallets are just as they sound – a bit of paper containing your public and private keys, which is typically a printout that contains a QR code that can be scanned. This is used to complete cryptocurrency transactions in a similar way that a hardware wallet is used to approve transactions. Paper wallets come with the same advantages as hardware wallets by keeping your crypto keys stored offline. The disadvantage however is that there is a learning curve required to learn how to create a paper wallet.

Best Practices For Storing Your Crypto

Here is a summary of how everything we have discussed can be used to help you store your cryptocurrency safely:

- Only use a hot wallet for small quantities of crypto that you are using for trading

- Hold the majority of your crypto in a cold wallet since it provides the most secure storage.

- Ensure you have recorded your seedphrase. Write it down and store it some place safe OFFLINE (bank safe for example).

- Under no circumstance should you ever share your seedphrase or private keys with anyone!

KEY TAKEWAY

Hot wallets are connected to the internet, are very convenient but are inherently less secure. Cold wallets are isolated from the internet, are extremely secure but are less convenient/accessible.

Disclaimer:

Investing always involves a level of risk. You aren’t guaranteed to make money, and it is possible to lose the money you start with. The author is not a financial advisor, so neither the author nor the publication takes any responsibility or liability for any investments, profits or losses you may incur as a result of this information. This content is intended for general informational and educational purposes only and may contain affiliate links. You should consider seeking independent legal, financial, taxation or other advice when considering whether an investment is appropriate for your objectives, financial situation or needs.