Unlock the door to your dream home faster by understanding and leveraging the First Home Super Saver Scheme with this comprehensive, tax-savvy guide.

First Home Super Saver Scheme At A Glance

Buying your first home can be both an exciting and daunting experience. With the Australian property market’s ever-increasing prices, the journey to homeownership may seem like an uphill battle. Fortunately, the Australian government introduced the First Home Super Saver (FHSS) Scheme to help first-time homebuyers get a foot in the door.

In this comprehensive guide, we will explore the First Home Super Saver Scheme explained in detail, with a focus on concessional and non-concessional contributions and their tax implications.

I have several Frequently Asked Questions (FAQs) in this post that answer many common questions about the FHSS scheme, so be sure to check them out!

Brief explanation of the First Home Super Saver (FHSS) Scheme

The First Home Super Saver (FHSS) Scheme, introduced in 2017, allows eligible Australians to save for their first home using their superannuation fund. This scheme provides tax advantages and encourages individuals to save for their first property purchase.

By understanding the ins and outs of the FHSS Scheme, you can unlock your first home sooner than you thought possible.

Importance of understanding the scheme for first-time homebuyers

As a first-time homebuyer, it is essential to understand the various government incentives and schemes available to you. The First Home Super Saver Scheme is one such initiative that can significantly impact your savings and expedite your journey to homeownership.

By leveraging this scheme’s tax benefits, you can make the most of your hard-earned money and achieve your homeownership goals.

Overview of concessional and non-concessional contributions

To fully grasp the First Home Super Saver Scheme’s advantages, it’s crucial to comprehend the difference between concessional and non-concessional contributions.

Each type of contribution has distinct tax implications, which we will discuss in detail in the following sections. By understanding these differences, you can effectively plan your contributions to maximize your savings and minimize your tax liability.

In this comprehensive guide, we will dive deep into the world of concessional and non-concessional contributions, tax implications, and expert tips on making the most of the First Home Super Saver Scheme. So, without further ado, let’s get started on your journey to unlock the door to your dream home!

Concessional Contributions

Definition and explanation of concessional contributions

Concessional contributions are often referred to as ‘before-tax‘ contributions because they are generally made from your pre-tax income.

These contributions are subject to a concessional tax rate of 15% within your superannuation fund, which is typically lower than most individuals’ marginal tax rates. By making concessional contributions, you can benefit from reduced taxable income, potentially resulting in significant tax savings.

Tax implications of concessional contributions

Before-tax contributions

As mentioned earlier, concessional contributions are taxed at a flat rate of 15% in your super fund, making them an attractive option for individuals with higher marginal tax rates. By redirecting some of your pre-tax income towards concessional contributions, you can reduce your taxable income and pay less tax overall.

Contribution caps

It’s essential to be aware of the concessional contributions cap to avoid any excess contributions tax. As of the 2023-2024 financial year, the annual concessional contributions cap is $27,500. If your concessional contributions exceed this cap, the excess amount will be included in your taxable income and taxed at your marginal tax rate, plus an excess concessional contributions charge.

In addition, if you have not fully utilized your concessional contributions cap in previous financial years, you may be able to carry forward unused cap amounts. This “carry-forward” rule allows you to make use of any unused concessional contributions cap from the previous five financial years, provided your total superannuation balance is less than $500,000 at the end of the previous financial year.

For example, if you made concessional contributions of $20,000 in the 2022-2023 financial year, you would have $7,500 of unused concessional cap. In the 2023-2024 financial year, you could contribute up to $35,000 ($27,500 for the current financial year plus the $7,500 unused cap from the previous year) without exceeding the cap.

This carry-forward rule can help individuals maximize their concessional contributions, especially if their income or capacity to contribute has fluctuated over the years. Remember to keep track of your concessional contributions and any unused cap amounts to make the most of this opportunity and avoid potential tax liabilities.

Examples of concessional contributions

- Employer contributions: Employer contributions, including the mandatory Superannuation Guarantee (SG) payments, are considered concessional contributions. Your employer is required to contribute a minimum of 10.5% of your salary (as of 2023) to your super fund, and these contributions are taxed at the concessional rate of 15%.

- Salary sacrifice arrangements: Salary sacrifice arrangements allow you to voluntarily contribute a portion of your pre-tax salary to your super fund. These contributions are also classified as concessional contributions and can result in tax savings, as they reduce your taxable income.

- Personal deductible contributions: If you’re self-employed or don’t have an employer who contributes to your super, you can make personal contributions to your super fund and claim a tax deduction for them. These deductible contributions are considered concessional contributions and are taxed at the concessional rate of 15%.

Understanding the tax implications of concessional contributions can help you make informed decisions when planning your contributions under the First Home Super Saver Scheme. By strategically utilizing concessional contributions, you can maximize your savings and minimize your tax liabilities.

Non-concessional Contributions

Definition and explanation of non-concessional contributions

Non-concessional contributions, also known as ‘after-tax’ contributions, are made from your post-tax income. Since these contributions have already been subject to income tax, they are not taxed again within your superannuation fund. Non-concessional contributions can help you save for your first home without any additional tax burden within your super fund.

Tax implications of non-concessional contributions

After-tax contributions

As non-concessional contributions are made from your after-tax income, they do not reduce your taxable income. However, the advantage of non-concessional contributions is that they are not subject to any additional tax within your super fund, making them an attractive option for individuals who have already reached their concessional contributions cap or want to top up their super savings.

Contribution caps

Non-concessional contributions are also subject to a cap. As of the 2023 financial year, the annual non-concessional contributions cap is $110,000.

If you are under 65 years of age, you can utilize the ‘bring-forward’ rule, which allows you to contribute up to three years’ worth of non-concessional contributions ($330,000) in a single financial year. If you exceed the non-concessional contributions cap, you may be subject to additional tax that exceeds your marginal rate, so it’s always best to check if you are planning to exceed these caps!

Examples of non-concessional contributions

- Personal after-tax contributions: You can make personal contributions to your super fund using your after-tax income. These contributions are considered non-concessional contributions and do not attract any additional tax within your super fund.

- Spouse contributions: If your spouse earns a lower income, you can contribute to their super fund on their behalf. These spouse contributions are classified as non-concessional contributions and can help both you and your spouse save for your first home under the First Home Super Saver Scheme.

- Government co-contributions: If you are a low or middle-income earner, the Australian government may provide a co-contribution to your super fund when you make personal after-tax contributions. These government co-contributions are considered non-concessional contributions and can boost your super savings for your first home.

By understanding the tax implications of non-concessional contributions, you can plan your contributions effectively to make the most of the First Home Super Saver Scheme. Balancing both concessional and non-concessional contributions can help you reach your savings goal faster and unlock the door to your dream home.

Frequently Asked Questions (FAQs) About the FHSS

When you withdraw concessional contributions under the First Home Super Saver (FHSS) Scheme, the Australian Taxation Office (ATO) withholds tax at your marginal tax rate, minus a 30% tax offset. This is because you have already paid a 15% tax on concessional contributions within your super fund.

Keep in mind that only 85% of your concessional contributions (salary sacrifice contributions and personal voluntary super contributions for which you have claimed a tax deduction) are eligible for withdrawal under the FHSS Scheme. This is to account for the 15% tax previously paid.

So, when you withdraw concessional contributions, the amount of tax withheld depends on your marginal tax rate, considering the 30% tax offset. For example, if your marginal tax rate is 30%, the tax withheld would effectively be 0% due to the tax offset. However, if your marginal tax rate is higher, say 37%, the tax withheld would be 7% (37% - 30%).

For non-concessional contributions withdrawn under the First Home Super Saver (FHSS) Scheme, no tax is withheld. Non-concessional contributions are made from your after-tax income, meaning you have already paid income tax on these amounts. Therefore, when you withdraw non-concessional contributions from your super fund under the FHSS Scheme, these amounts are not subject to any additional tax.

It's important to remember that the FHSS maximum release amount includes 100% of your eligible non-concessional contributions (personal voluntary super contributions for which you have not claimed a tax deduction) and the associated earnings.

If you have submitted a notice of intent to claim a tax deduction on your non-concessional contributions, these contributions effectively become concessional contributions. When you withdraw these contributions under the First Home Super Saver (FHSS) Scheme, they will be treated and taxed as concessional contributions.

Upon withdrawal, only 85% of these now-concessional contributions will be eligible for release, as the 15% tax on concessional contributions within your super fund has already been paid. When you receive the withdrawn concessional contributions, they will be included in your taxable income for the financial year. However, you will receive a 30% tax offset to account for the 15% tax already paid on these contributions.

This means that the effective tax rate on these withdrawn concessional contributions will be your marginal tax rate minus the 30% tax offset. It's essential to consider this tax liability when planning your budget for your first home purchase and when choosing whether to claim a tax deduction on your non-concessional contributions.

Under the First Home Super Saver (FHSS) Scheme, the maximum amount you can withdraw is determined by considering the limits on both concessional and non-concessional contributions, as well as the associated earnings. When calculating the FHSS maximum release amount, the following components are included:

- 100% of your eligible personal voluntary super contributions that you have not claimed a tax deduction for (non-concessional contributions)

- 85% of your eligible salary sacrifice contributions (concessional contributions)

- 85% of eligible personal voluntary super contributions for which you have claimed a tax deduction (concessional contributions)

Please note that if you claim a tax deduction on your non-concessional contributions, they effectively become concessional contributions, and the 85% limit will apply to them when determining the maximum release amount.

The total amount you can withdraw under the FHSS Scheme is subject to a $15,000 limit per financial year and a $50,000 total limit across all years for the sum of eligible contributions.

These limits are applied before adding the associated earnings. The associated earnings are calculated using a deemed rate set by the Australian Taxation Office (ATO) and are added to the eligible contributions to determine the maximum release amount.

How the First Home Super Saver (FHSS) Scheme Works

Overview of the FHSS Scheme

The First Home Super Saver Scheme allows eligible first-time homebuyers to withdraw voluntary concessional and non-concessional contributions from their superannuation fund, along with the associated earnings, to use as a deposit for their first home. The scheme aims to help Australians save for their first home faster by utilizing the tax advantages of superannuation contributions.

Eligibility criteria for the FHSS Scheme

To qualify for the FHSS Scheme, you must meet the following criteria:

- You have never owned property in Australia, including residential, commercial, or investment properties.

- You have not previously released funds under the FHSS Scheme.

- You are at least 18 years old.

- You intend to reside in the property for at least six months within the first 12 months of ownership.

Maximum withdrawable amount

Under the FHSS Scheme, you can withdraw eligible contributions and associated earnings, subject to certain limits. The FHSS maximum release amount considers the sum of your eligible contributions, taking into account the yearly and total limits, along with the associated earnings. This amount includes:

- 100% of your eligible personal voluntary super contributions that you have not claimed a tax deduction for (non-concessional contributions)

- 85% of your eligible salary sacrifice contributions (concessional contributions)

- 85% of eligible personal voluntary super contributions for which you have claimed a tax deduction (concessional contributions)

- An amount of deemed earnings associated with the contributions above.

It’s important to note that mandatory employer contributions, such as the Superannuation Guarantee, cannot be withdrawn under the FHSS Scheme.

When calculating the eligible contributions, the FHSS maximum release amount takes into account the $15,000 limit per financial year and the $50,000 total limit across all years. After considering these limits, the associated earnings are added to determine the total amount that can be withdrawn under the scheme.

By understanding the components and limits of the FHSS maximum release amount, you can better plan your contributions and withdrawals to make the most of the First Home Super Saver Scheme in your home-buying journey.

How to apply for the FHSS Scheme

To access your savings under the FHSS Scheme, you need to follow these steps:

- Check your eligibility for the scheme, as discussed earlier in this section.

- Ensure that you have made voluntary concessional or non-concessional contributions within the allowed limits.

- Request a determination from the Australian Taxation Office (ATO) through your myGov account. The ATO will inform you of the maximum amount you can withdraw under the FHSS Scheme.

- Once you receive the determination, you can submit a request to release your funds. The ATO will then transfer the requested amount to your nominated bank account, typically within 15-25 business days.

Understanding how the First Home Super Saver Scheme works is vital to make the most of this government initiative. By carefully planning your contributions and meeting the eligibility criteria, you can use this scheme to fast-track your journey to homeownership.

Tax Implications of the FHSS Scheme

When you withdraw funds under the First Home Super Saver Scheme, it is crucial to understand the tax implications associated with these withdrawals.

The tax treatment of withdrawn funds depends on whether they are concessional or non-concessional contributions.

Tax treatment of withdrawn concessional contributions

When you withdraw concessional contributions under the FHSS Scheme, these amounts are included in your taxable income for the financial year. However, you will receive a 30% tax offset to account for the 15% tax already paid on these contributions within your super fund.

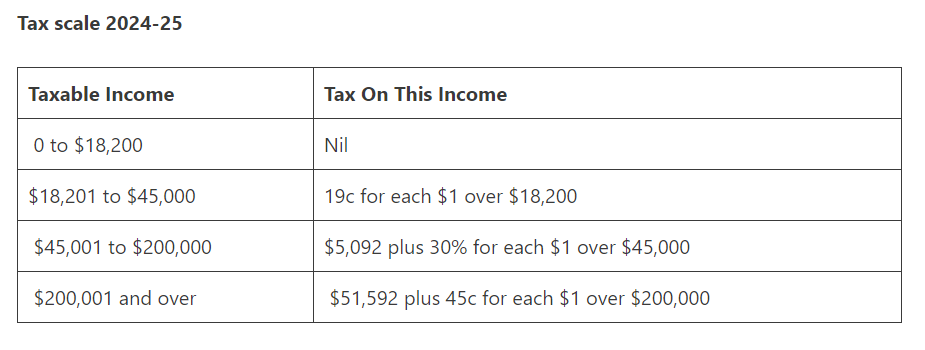

This means that the effective tax rate on withdrawn concessional contributions is your marginal tax rate minus the 30% tax offset. It’s essential to consider this tax liability when planning your budget for your first home purchase.

It is important to note that starting July 2024, the marginal tax rates are changing, which will have a significant impact on the FHSS Scheme. For the majority of income earners in the $45,001 to $200,000 bracket, they will benefit from a 30% marginal tax rate. This change effectively means that the 30% tax offset provided by the FHSS Scheme will completely offset any additional tax liability for individuals in this income range, making the scheme even more advantageous for prospective first home buyers.

Tax treatment of withdrawn non-concessional contributions

Non-concessional contributions withdrawn under the FHSS Scheme are not subject to any additional tax. Since these contributions were made using after-tax income and have already been subject to income tax, they can be withdrawn tax-free. This tax treatment makes non-concessional contributions an attractive option for topping up your savings for your first home.

How to minimize tax liability using the FHSS Scheme

To minimize your tax liability when using the First Home Super Saver Scheme, consider the following strategies:

- Plan your withdrawals strategically, considering your marginal tax rate and any other income you may receive during the financial year.

- Consult a professional ATO accountant for tailored advice on how to optimize your contributions and withdrawals for tax efficiency.

- Understanding the tax implications of the First Home Super Saver Scheme is essential for effective financial planning. By considering the tax treatment of withdrawn funds and implementing strategies to minimize tax liability, you can make the most of this government initiative and move one step closer to owning your dream home.

Tips and Strategies for Maximizing the Benefits of the FHSS Scheme

By implementing the following tips and strategies, you can maximize the benefits of the First Home Super Saver Scheme and achieve your homeownership goals more efficiently:

Planning for tax efficiency

When using the FHSS Scheme, it’s crucial to plan your contributions and withdrawals with tax efficiency in mind. Ensure you are aware of your concessional contributions cap to avoid excess contributions tax. Additionally, consider the tax implications of withdrawn funds when planning your home purchase budget. Consulting a professional ATO accountant can provide valuable insights and help you create a tailored plan that suits your financial situation.

Using the scheme in conjunction with other government incentives

The First Home Super Saver Scheme is just one of several government initiatives designed to assist first-time homebuyers. Combining the FHSS Scheme with other incentives, such as the First Home Owner Grant or the First Home Loan Deposit Scheme, can help you save even more towards your first home purchase. Research the available incentives in your state or territory and determine your eligibility to maximize your savings.

Conclusion

The First Home Super Saver Scheme is a valuable tool for Australians looking to enter the property market for the first time.

By understanding the intricacies of concessional and non-concessional contributions, the tax implications, and the strategies to maximize the scheme’s benefits, you can unlock the door to your dream home sooner than you ever thought possible.

As a first-time homebuyer, it’s essential to seek professional advice to ensure you’re making the most of the available government incentives and maximizing your savings. An experienced ATO accountant can provide personalized guidance and help you navigate the complexities of the First Home Super Saver Scheme, ultimately bringing you one step closer to achieving your homeownership goals.

Don’t let the dream of homeownership slip away. Start planning your contributions and take advantage of the First Home Super Saver Scheme today!