Cryptocurrency Taxes In Australia Made Easy

Wondering how to do your cryptocurrency taxes in Australia? This comprehensive guide has you covered. Here’s what you’ll find:

- Understanding Cryptocurrency Taxes in Australia: Learn how cryptocurrencies are taxed and what you need to report on your tax return.

- The Role of Koinly in Crypto Tax Calculation: Discover how Koinly can simplify the process of calculating your crypto taxes.

- How to Use Koinly for Your Crypto Taxes: Follow a step-by-step guide on setting up and using Koinly for your crypto taxes.

- Tips for Cryptocurrency Tax Compliance: Get advice on staying compliant with your cryptocurrency taxes and minimizing your tax liability.

- Preparing for the Tax Season: Find out what to expect in the tax season and how to prepare.

- Frequently Asked Questions: Get answers to common questions about cryptocurrency taxes and Koinly.

Whether you’re a seasoned crypto investor or just starting out, this guide will help you navigate your cryptocurrency taxes with ease. Let’s dive in!

Understanding Cryptocurrency Taxes in Australia

Navigating the world of cryptocurrency taxes in Australia can be a daunting task, especially if you’re new to the crypto space or have a large number of transactions to account for.

Trust me, I’ve been there.

In the financial year 2021-2022, I had over 1500 transactions to manage. Without the right tools, this can quickly turn into a time-consuming and stressful endeavor.

Cryptocurrencies, or as some prefer to call them, digital currencies, are treated as property for tax purposes in Australia. This means that they’re subject to capital gains tax (CGT) and must be reported on your tax return.

Every time you sell, trade, or gift your cryptocurrencies, you’re potentially triggering a taxable event. Even crypto-to-crypto trades are considered taxable events, not just when you cash out to Australian dollars.

But it’s not all doom and gloom. If you hold your cryptocurrency as an investment for 12 months or more, you may be eligible for a 50% CGT discount. And if your crypto transactions are part of a business operation, you might be able to claim losses and expenses.

The Australian Taxation Office (ATO) has made it clear that they’re keeping a close eye on cryptocurrency transactions. They’re working with Australian cryptocurrency designated service providers (DSPs) and other international organisations to ensure all crypto investors are paying their fair share.

So, it’s more important than ever to understand your crypto tax obligations in Australia and to have a reliable system in place for calculating and reporting your taxes.

That’s where Koinly comes in. It’s a software that automates the process of calculating your crypto taxes, saving you hours of manual work.

Remember, while this guide provides a general overview, everyone’s situation is unique. So, it’s always a good idea to consult with a tax professional or a tax agent who’s familiar with cryptocurrency.

The Role of Koinly in Crypto Tax Calculation

If you’ve ever tried to calculate your cryptocurrency taxes manually, you know it’s no walk in the park.

Between tracking down transactions from multiple exchanges, accounting for transfers, and figuring out the cost basis for each trade, it can quickly become a full-time job. I’ve been there, and it’s not fun.

That’s where using Koinly for crypto taxes can come in handy.

Koinly is a cryptocurrency tax software designed to make your life easier. It automates the process of tracking your transactions, calculating your gains and losses, and even generating tax reports. It’s like having a personal tax assistant who specializes in cryptocurrency.

And here’s an added bonus: if you decide to take out a paid plan with Koinly, it can be considered an expense for managing your tax affairs. This means you may be able to deduct the cost of your Koinly subscription on your tax return, saving you even more money.

Here’s how it works: Koinly syncs with over 300 exchanges, wallets, and blockchains to import your transactions. It then applies the appropriate tax rules based on your country – in our case, Australia – and calculates your capital gains and income.

The result? A detailed tax report that you can download and include with your tax return, or send directly to your tax agent.

But Koinly isn’t just about making tax time easier. It’s also a powerful tool for keeping track of your crypto portfolio. You can monitor the performance of your investments, see the breakdown of your assets, and get insights into your trading habits.

You don’t need to be a tax expert or a tech whiz to use Koinly. Its interface is user-friendly, and if you ever get stuck, there’s a wealth of guides and resources available on their website.

Managing crypto taxes with Koinly can save you time, stress, and potentially even money when tax time rolls around.

How to Use Koinly for Your Crypto Taxes

If you’re like me, you’re probably thinking, “This sounds great, but how do I actually use Koinly?” Don’t worry, it’s easier than you might think. Let’s walk through the process of crypto tax calculation with Koinly.

Step 1: Create Your Koinly Account

First things first, you’ll need to create an account on Koinly. It’s a straightforward process – just provide your email address, create a password, and you’re in. Remember, if you decide to sign up for a paid plan, you can use my referral link to get a discount.

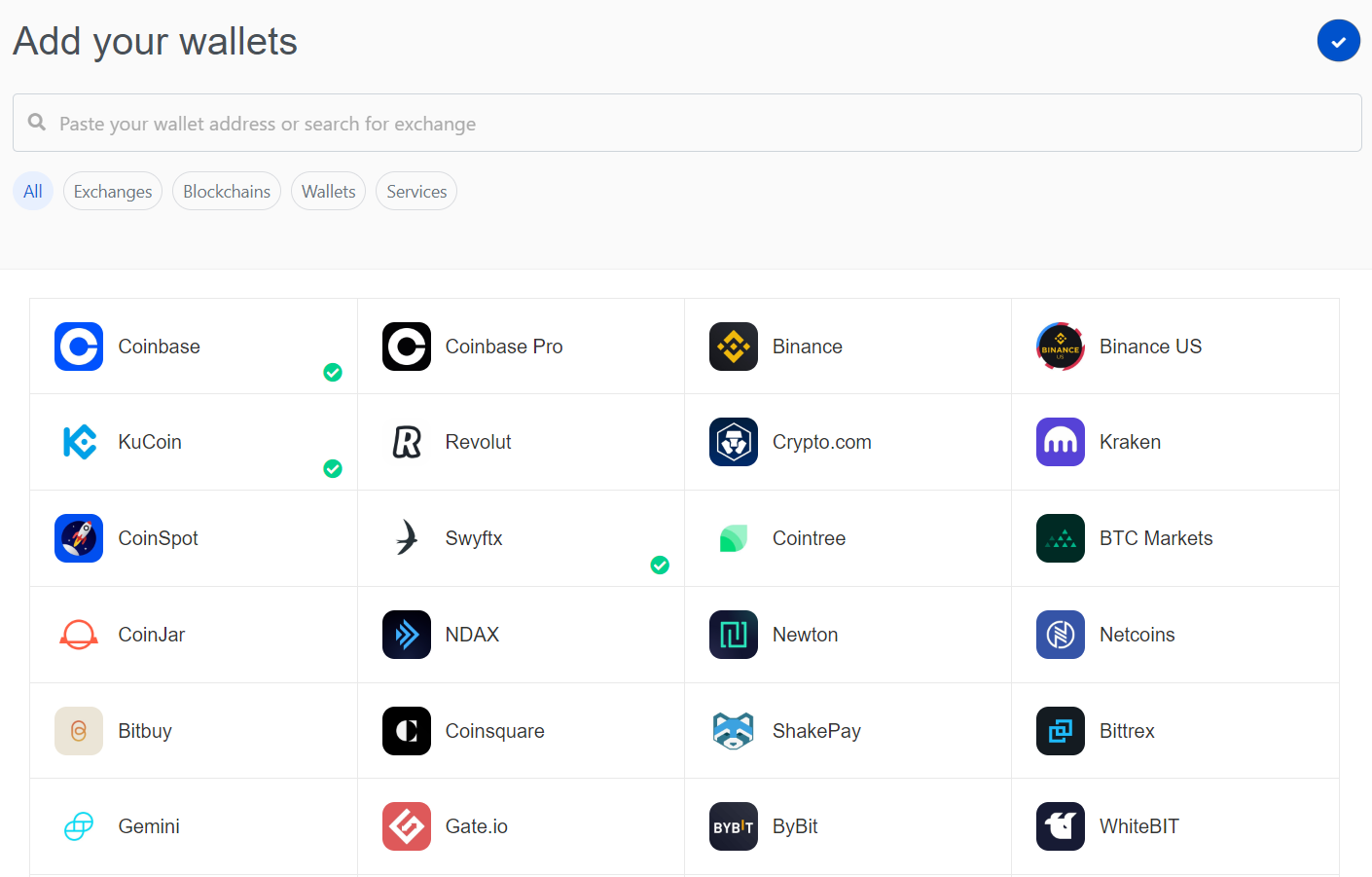

Step 2: Connect Your Wallets and Exchanges

Next, you’ll need to connect Koinly to your crypto wallets and exchanges. This is how Koinly tracks your transactions. You can do this by importing a CSV file or by connecting directly via API. Koinly supports over 300 different wallets and exchanges, so chances are, yours will be on the list.

Step 3: Review Your Transactions

Once your wallets and exchanges are connected, Koinly will automatically import your transaction history. It’s a good idea to review these transactions to make sure everything looks correct. If you notice any discrepancies, Koinly has tools to help you reconcile them.

Step 4: Generate Your Tax Report

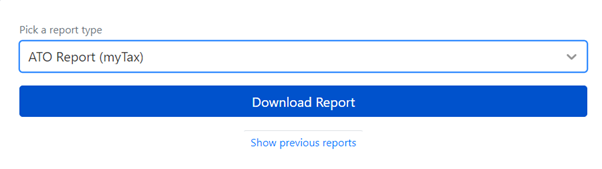

Now for the fun part – generating your tax report. Once you’re satisfied that all your transactions are correct, you can go ahead and create your report.

Koinly calculates your capital gains and income based on Australian tax rules and provides a detailed breakdown of your crypto taxes for the year. You can download this report and include it with your tax return, or send it directly to your tax agent.

And that’s it! With Koinly, what used to be a complex and time-consuming process can be done in a few easy steps. It’s a simple, effective way to handle your cryptocurrency taxes in Australia. And remember, if you have any questions along the way, Koinly’s support team is there to help.

Tips for Cryptocurrency Tax Compliance in Australia

Cryptocurrency taxes can seem complex, but with the right approach and tools like Koinly, it becomes much more manageable. Here are some tips to help you stay on top of your crypto tax obligations in Australia.

Keep Detailed Records

One of the keys to managing your crypto taxes is keeping detailed records of your transactions. This includes the date of each transaction, the value in Australian dollars at the time, what cryptocurrency was involved, and the purpose of the transaction. Koinly can help automate this process, but it’s still a good idea to keep your own records as a backup.

Understand Your Tax Obligations

Different types of crypto transactions are taxed differently. For example, if you’re trading cryptocurrencies, each trade is considered a taxable event and subject to capital gains tax. But if you’re earning crypto from mining or staking, it may be considered income and taxed accordingly. Make sure you understand the tax implications of your specific activities.

Don’t Forget About Lost or Stolen Cryptocurrency

If your cryptocurrency is lost or stolen, you may be able to claim a capital loss. However, the ATO has specific rules about what constitutes a loss. It’s important to understand these rules and to keep any evidence that supports your claim.

Avoid Wash Sales

The Australian Taxation Office (ATO) has been actively cracking down on wash sales in the cryptocurrency space. Cryptocurrency wash sales involve selling cryptocurrency at a loss and quickly repurchasing it, potentially to claim artificial capital losses for tax purposes. The ATO considers such practices as attempts to gain inappropriate tax benefits and closely scrutinizes them. It is crucial for cryptocurrency investors to accurately report their gains and losses from transactions and comply with the ATO’s guidelines to avoid penalties and legal consequences.

Consider Professional Help

Cryptocurrency taxes can be complex, and the stakes are high. If you’re not confident in your ability to calculate your taxes correctly, it may be worth seeking help from a tax professional who’s familiar with cryptocurrency.

Use Koinly to Simplify the Process

Koinly is a powerful tool that can simplify the process of calculating your cryptocurrency taxes. It automatically tracks your transactions, calculates your gains and losses, and generates a tax report that’s ready to include with your tax return.

Remember, staying compliant with your cryptocurrency taxes is not just about avoiding trouble with the ATO. It’s also about being a responsible member of the crypto community. By paying your fair share, you’re helping to legitimize cryptocurrency and pave the way for its wider acceptance in Australia.

Preparing for the Tax Season

With the end of the financial year approaching, it’s time to start preparing for tax season. If you’ve been investing in cryptocurrency, this can feel like a daunting task. But don’t worry, with some preparation and the right tools, you can navigate tax season with ease. Here’s how:

Start Early

Don’t wait until the last minute to start preparing your crypto taxes. The sooner you start, the less stressful the process will be. If you’ve been using Koinly throughout the year, a lot of the work will already be done for you. If not, now’s the time to get started.

Review Your Transactions

Go through your transactions for the year and make sure everything is accurate. This includes checking that all your wallets and exchanges are connected to Koinly, and that all transactions have been correctly classified. If you spot any errors, now’s the time to fix them.

Understand the Tax Rules

The ATO has specific rules for how different types of crypto transactions are taxed. Make sure you understand these rules and how they apply to your situation. If you’re unsure, consider seeking advice from a tax professional.

Generate Your Tax Report

Once you’re confident that all your transactions are correct, you can generate your tax report in Koinly. This report will provide a detailed breakdown of your capital gains and income from crypto for the year. You can include this report with your tax return, or send it directly to your tax agent.

Stay Informed

Tax laws and regulations around cryptocurrency can change. Stay informed about any updates to ensure you’re always in compliance. Koinly’s blog is a great resource for staying up-to-date on the latest news and changes.

Remember, preparing for tax season doesn’t have to be stressful. With some preparation and the right tools, you can navigate your cryptocurrency taxes with ease. And if you need a hand, Koinly is there to help.

Frequently Asked Questions (FAQs)

Cryptocurrency taxes can be a complex topic, and it’s natural to have questions. Here are some of the most common questions people have about cryptocurrency taxes in Australia and using Koinly.

1. How are cryptocurrencies taxed in Australia?

2. What if I only trade between cryptocurrencies, not into Australian dollars?

3. Can I claim a loss if my cryptocurrency is stolen or lost?

4. How can Koinly help with my cryptocurrency taxes?

5. Is Koinly difficult to use?

Remember, while this FAQ section answers some common questions, everyone’s situation is unique. If you have specific questions about your own situation, it’s always a good idea to consult with a tax professional or a tax agent who’s familiar with cryptocurrency.

Conclusion

Navigating the world of cryptocurrency taxes in Australia can seem like a daunting task. But with the right knowledge and tools, it doesn’t have to be. By understanding how cryptocurrencies are taxed and using tools like Koinly to automate the process, you can take control of your crypto taxes and approach the tax season with confidence.

Remember, staying compliant with your cryptocurrency taxes is not just about avoiding trouble with the ATO. It’s also about being a responsible member of the crypto community. By paying your fair share, you’re helping to legitimize cryptocurrency and pave the way for its wider acceptance in Australia.

And while this guide provides a general overview, everyone’s situation is unique. If you have specific questions about your own situation, it’s always a good idea to consult with a tax professional or a tax agent who’s familiar with cryptocurrency.

Cryptocurrency is an exciting and rapidly evolving field. By staying informed and prepared, you can make the most of your investments while staying on the right side of the law. So here’s to a successful tax season, and to the exciting future of cryptocurrency in Australia!

Call to Action

Now that you’re equipped with the knowledge and tools to tackle your cryptocurrency taxes in Australia, it’s time to take action. Don’t wait until the last minute to start preparing for tax season. With Koinly, you can start tracking your transactions, calculating your gains and losses, and preparing your tax report today.

Remember, Koinly supports over 300 exchanges, wallets, and blockchains, so you can manage all your crypto transactions in one place. And if you use my referral link, you can get a discount on your Koinly subscription.

So why wait? Take control of your crypto taxes today and make this tax season a breeze. Start your Koinly journey now and join the community of crypto investors who are navigating their taxes with ease. Happy investing!

Simplify Your Crypto Taxes With Koinly

Automate the process of managing your cryptocurrency tax affairs today