If given the opportunity to go back in time, what would you tell your younger self to help accelerate your journey to becoming wealthy?

Imagine having the power to rewind time. What financial advice would you give your younger self to speed up your journey to wealth?

Sure, we’d all love to pull a ‘Back to the Future’ move and hand over winning lottery numbers. But let’s get real and talk about practical steps to accelerate wealth accumulation.

Fantasies aside, there are several concepts that I wish I knew back in high school that could have greatly accelerated my journey to wealth creation.

But even if you have long passed on from high school, these principles that we are going to discuss are relevant to anyone, not just high school students — the sooner you know them the sooner you can put them to use, so let’s discuss.

Wealth Isn't Just About Your Paycheck

First and foremost, let’s debunk a common myth: your salary is the sole determinant of your wealth.

But what exactly do we mean by wealth?

To answer that, let’s look at some common terminology thrown around in the finance world. The terms “rich” and “wealthy” are usually used interchangeably, but there is an important distinction between the two.

To understand this distinction, let’s dissect the following question:

If you stopped working today…How long could you survive financially?

We’re talking about survival at your current standard of living — Given your current level of expenses, how long would your money last?

…A week?

…A month?

…A year?

…A decade?

When we think of it this way, we can think of the term ‘rich’ as a measure of money, and ‘wealth’ as a measure of time.

Put simply, someone who is rich may have a large amount of money, but it does not necessarily guarantee that they are wealthy. Since wealth is essentially a person’s ability to survive x number of years whilst maintaining their current standard of living.

Your Lifestyle Choices Matter

Unfortunately, while most of us are taught how to make money — how to get a job and how to work hard — we are typically not taught the most vital part…how to intelligently manage wealth.

So what is the key to intelligently managing money? Well it depends on our lifestyle and the day to day expenses incurred by that lifestyle.

We all have our own unique obligations, interests, hobbies and passions, so it may not come as a huge surprise…. that our expenses revolve around these items. For that reason…. not all expenses are created equal and they can make or break our potential to achieve wealth.

Let’s use a simple case study to further dive into what wealth may look like. Consider the following two hypothetical people with contrasting lifestyles:

Person A:

- Annual salary: $75,000

- Lifestyle: lives a frugal life, drives a second-hand car, avoids non-essential purchases

- Paycheck savings: Saves 50% of their pay check

Person B:

- Annual salary: $150,000

- Lifestyle: Drives the latest model BMW, frequent luxury item purchases, enjoys fancy dinners out

- Paycheck savings: Spends all of their paycheck plus more in credit cards

Despite the significantly higher income earned by Person B, the heavy consumption-driven lifestyle translates into high expenses and little savings. Therefore, if this person had been working for 5 years and then all of a sudden lost their job, it would likely be the case that they could not even survive 1 full year of their existing high expense lifestyle.

On the contrary, if Person A had been working for 5 years and they similarly lost their job, given that they maintain their existing lifestyle, they could survive for 5 years based off their savings alone.

Ultimately, the point of this is to show that it’s not about how much one is earning that dictates how to become wealthy.

Of course, the lower your income, the harder it is to save higher percentages – but that’s what it ultimately narrows down to, how much you can save – that’s what determines long-term wealth accumulation.

Consider this, do you ever wonder why you so often hear of lottery winners who blow all of their winnings in a mere matter of months/years? It’s the same principle taken to its extreme — where a person’s expenses catch up to or overtake their income, at which point it is no longer sustainable.

Now that we have a bit of an understanding about wealth — how can we make the hard-earned money that we save make more effectively for us?

That’s what the next section is for — investing.

Investing: A Simple Path to Wealth Accumulation

Investing can seem daunting, but it’s simpler than you think. The goal is to make your money work for you, even while you sleep.

However, there is so much stigma and fear associated with the idea of investing.

Often I hear, “I’m not smart enough”, or “I don’t have the time to research and understand it”. These are the common responses and misconceptions normal everyday people feel about investing.

But out of all the excuses or responses you can hear, my personal favourite is:

“But it’s so much safer to keep my money locked up in a savings account”

One word — inflation.

Ask yourself “what is the inflation rate?”. Well, in 2023, it was well over 7% here in Australia.

Now ask yourself this: “What is the interest rate offered by my bank where my savings are kept?” I can answer this for you, probably substantially far less than 7%…

So if the price of goods is increasing (inflation) at a higher rate than your money is earning you, you tell me whether that’s a ‘safer’ option.

Your money is losing value.

So why do we invest?

To me, the ultimate goal in this game we call life is to be able to pay our bills while we sleep. That’s really it — it’s the ultimate thing money can buy, because if we can achieve just that, then we have the freedom to do whatever we want without fear of making ends meet.

So the reason I invest is to work towards this idea — to have my money work for me on autopilot to attain wealth.

Ultimately, it is my goal to have enough passive income paying me from my investments such that it covers my expenses. At that point, I will have reached financial independence. There are many methods, approaches and techniques out there that aim to expedite how fast someone can reach this measure of financial independence, but we will discuss these in depth another time.

For now, I want to draw our attention to perhaps the most well-known way to invest — the stock market.

I know it can sound daunting, but to win at investing in the stock market is really quite simple, all it takes is time, and well…more time. Without going into too much detail (because I discuss this topic in much more detail here), one of the most reliable and proven methods to consistently grow your investment portfolio and build wealth is to invest in index funds or Exchange Traded Funds (ETFs).

An ETF or index fund is typically a low-cost, moderate-risk investment portfolio of shares that tracks a financial market.

Instead of buying a stock of a single company, you buy a stock that has pieces of hundreds of other companies that act together to mimic the performance of the entire stock market, instead of a single company.

This reduces risk, and most importantly doesn’t require a fund manager to look after your investment who would otherwise charge you through the roof for doing so.

Don’t just take my word for it though, based off historical data, the stock market typically grows each year and produces an annual return of 5–10%. So if we simply invest in an index fund, we can expect to see these levels of returns.

But where the real power lies, and why investing in the stock market is so powerful, is all because of a little something known as compound interest.

The Magic of Compound Interest

Compound interest is the secret sauce of investing. It’s the process of earning interest on your interest, causing your wealth to grow exponentially over time. The longer you invest, the more powerful the compounding effect.

Compound interest is essentially how to build wealth on autopilot.

The traditional example of compound interest is holding a stock over a very long period. If your stock earns a gain one year, you take that gain and add it to your original investment. If you repeat this each year and keep adding these gains, the constant reinvestment of the gains produces a compounding effect.

You essentially earn gains, on your gains, on your gains…. (You get the picture).

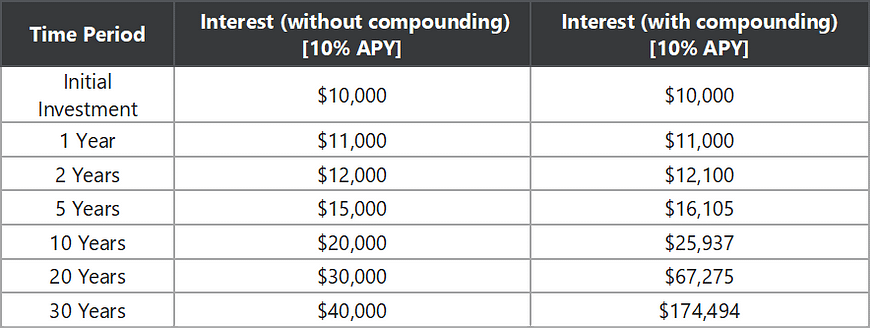

Think of it this way. Let’s say you invest $10,000 at a rate that earns 10% interest each year.

After the first year, you receive a $1,000 interest payment. But, instead of putting it in your pocket, you reinvest it at the same 10% rate. This means that after 1 year, you now have $11,000 to invest.

When you invest this in your second year, your interest is now calculated on an $11,000 investment (and not your original $10,000 investment), which comes to $1,100.

If you reinvest that and continue to do so year after year, by year 30 your initial $10,000 investment would now be an incredible $174,494!

Compound interest means that your initial investment (and the interest it generates) gets larger over time. It’s easy to see why time really is one the most powerful resources an investor can have to accumulate wealth.

FYI: There are many calculators available online that you can play around with to test the effects of compounding interest.

Here’s the one I created that you can play around with: Compound Interest Calcultor – Predict Your Future Earnings

Tackle Your Debt Head-On

We’ve talked about the amazing concept of compound interest? Well unfortunely it can work against our favour when it comes to debt.

History has shown us that the stock market performance typically increases each year, but that does not mean it is guaranteed to. The market is always prone to crashes and can drop in value, or suffer a series of consecutive years where it has negative returns.

But do you know what is guaranteed though? The 20% + interest fee you need to pay on top of the credit card debt you’ve racked up.

If this sounds familiar, and you do have an amount of debt that is still to be paid off, then this is one of your first priorities. I repeat, THIS is one of your first priorities.

Essentially, if you’re paying a 20% interest fee on your debts each year, it may not necessarily be a good idea to start investing any amount of money into the stock market since this is expected (and not guaranteed) to return only 5–10% each year.

Don’t get me wrong, a 5-10% return each year is fabulous, but not if your credit card debt is racking up twice and fast! So you may be better of clearing the higher debt and ridding yourself off the high interest repayments before starting off investing into the market. Otherwise your wealth accumulation journey could be hindered.

Credit Cards: A Double-Edged Sword

Credit cards, although they do have the potential to act as an enormous financial burden if high levels of debt are accumulated, they do also have the potential to boost your credit score substantially if used smartly.

So rather than using a credit card to purchase unnecessary luxury items or products, if you were to, say, use it to purchase essential items such as groceries, then it could help you demonstrate to financial institutions punctual repayments.

But remember! Always pay the full balance at the end of each month on time, otherwise you will be copped with a hefty interest fee, and we definitely want to avoid that like the plague!

Another reason why credit cards can be beneficial is that often they will have a loyalty program or rewards point system, where customers can earn points that can go towards vouchers, discounts, or even travel points. So if you use your credit card wisely, the accumulated points can actually help you save money and attain wealth in the long-term.

Small Expenses Add Up

One of the last things I will leave you to ponder is the idea that small and almost insignificant daily expenses can add up to great amounts.

Say for example you spend $5 for a coffee each day, that doesn’t seem like much, right? But if you apply that across, say, 30 years? Well, then the total dollars spent over that period come out to be $39,000.

But consider what earnings you are missing out on had you instead invested that money in the stock market. Assuming a 5% annual return, that $39,000 would now be worth $90,161.35, a whopping increase of $51,161.35.

So the question you should ask yourself is this: Is what I am periodically spending my money on worth the $51,161.35 interest earnings that I am passing up in the process?

That’s why it’s important to clearly outline your day-to-day expenses, and really scrutinise your spending habits to see if you have any unnecessary expenses that may be eating away at your potential earnings.

P.S. here’s a link to a calculator you can use to assess the real cost of periodic, seemingly insignificant spending just like the coffee example.

Balance Is Key

While it’s important to save and invest, don’t forget to enjoy life.

let me make this clear – I’m not saying you should change your entire lifestyle in the pursuit of building wealth.

In fact, what’s the point of living frugally if you can’t enjoy the things in life that make you happy. This article isn’t to try and judge you, it’s merely a guide to look at your habits in moderation and contemplate the long term financial impact of your current decisions.

Do you really need to splurge x amount of dollars on that luxury product? Is it truly what brings you joy? Or can that joy be found elsewhere?

Ultimately, much like Rome wasn’t built in a day, your financial future isn’t built over night. By questioning your spending habits and evaluating whether they are in the best interest of your future, you will become more mindful of your money. And being mindful of your money is how you become wealthy.

The goal isn’t to deprive yourself of joy, but to make informed financial decisions that align with your interests and long-term wealth building goals.

Remember, building wealth is a marathon, not a sprint.

Thanks for joining me on this journey to wealth. Here’s to mastering the art of wealth!

Disclaimer:

Investing always involves a level of risk. You aren’t guaranteed to make money, and it is possible to lose the money you start with. The author is not a financial advisor, so neither the author nor the publication takes any responsibility or liability for any investments, profits or losses you may incur as a result of this information. This content is intended for general informational and educational purposes only and may contain affiliate links. You should consider seeking independent legal, financial, taxation or other advice when considering whether an investment is appropriate for your objectives, financial situation or needs.