Let’s discuss how my $2,000 investment increased in value by more than 15x in just a matter of months

Welcome back,

I’m glad you’ve joined me for this one because it’s a bit of a bittersweet post for me.

On one hand, I’ll be talking about perhaps the best investment I have ever made to date. However, on the other hand, I’ll also be talking about how my inability to time the market and sell my investment at its peak ultimately prevented me from cashing out and realizing a 15x gain.

How Did My Investment Go From $2,000 To $30,000 In Two Months?

The investment I am going to talk about today is one that is immersed within the NFT crypto space.

But before we get into it, I want to first get a few things off my chest relating to the NFT crypto space.

We’ve all seen and heard it before – post upon post of people trying to force “the best crypto to buy right now” or the “best NFT to buy” down your throat because it can “make you generational wealth overnight”. And if you’re like me, you’re probably sick to death of hearing this type of stuff.

Now I will be the first to agree that fortunes can be forged from within the NFT market and crypto market. However, the harsh reality is that finding “the best crypto to buy right now” or “best NFT to buy” is not something that your average everyday Joe can just head on down to the shops and pick up on sale.

In fact, picking an NFT project that has high potential is not easy at all. I’d say about 99% of all NFT projects will fail or are absolute garbage. So picking that 1% is very tough… Ultimately, it all comes down to the project founders. The success of a project is directly related to how it is founded and operated. So it’s more about investing in founders as opposed to investing in NFTs.

But even if you do get lucky and find yourself the cream of the crop NFT crypto asset with strong potential, actually timing when to buy in and sell out is another challenge in its own right.

“Why so pessimistic, Nate?” I hear you asking.

It’s not that I am suggesting that crypto or NFT marketplaces are the devil and that you should avoid them at all costs.

I’m just being real and saying that you shouldn’t expect to make 15 x returns on the first NFT you lay your eyes on.

It’s possible, but not plausible.

It Wasn't Just Luck

That brings me to my next point. What was, and how did I come across the investment that turned $2,000 into $30,000 in the span of a few months?

Well for starters, although the rapid growth to $30,000 outperformed my initial expectations, this wasn’t just some fluke or ‘keep shooting blanks until one lands’ type of investment.

No, instead it was the result of what was quite a strenuous couple of months surveying the NFT space and conducting a fair share of due diligence before throwing down my money into ‘just another jpeg’.

In fact, I scoured Twitter and followed the project founder for months before the project had even been released, learning as much as possible and preparing myself.

It was because of this dedication that I was able to obtain a whitelist spot for this particular project, or in other words – exclusive access to purchase the project’s NFTs upon their release.

And that’s exactly what I did.

What Is This Project And Why Did I Buy In?

“Get to the God damn point already” I hear you frustratingly groan, what is THE PROJECT?!

I think you’ve figured out by now that the project that turned $2,000 into $30,000 was an NFT project. But it wasn’t just any old NFT project created by some anonymous user down in their basement.

This one is different, it has substance, long-term vision and most importantly the founder(s) have experience running a business.

The name of this project is Psychedelics Anonymous.

Psychedelics Anonymous Described In A Paragraph

In summary, Psychedelics Anonymous (PA) is a web3 brand as opposed to an NFT project. It wasn’t so much the look of the NFTs that captivated me. Instead, it was more about what the vision of the project stood for. PA aims to build its own unique path in both the digital (web3) and physical world, as a full-blown brand/business, rather than just as an NFT project. But the thing that really stuck for me is that at its core, PA exists to provide mental health services + educational resources and an ecosystem for everyone, especially those battling depression, anxiety, PTSD, and more. And that’s something I wanted to support and be a part of.

If you do want more information, the tweet I have linked below by a PA member summarizes everything you need to know about the PA verse very nicely!

You asked so I delivered 🤝 Here's the freshly updated beginner's guide for our new friends joining the #PAverse 🅿️🚀@psychedelic_nft @BAYC2745 pic.twitter.com/hZTGImRB8K

— klöss.eth (@kloss_eth) June 30, 2022

My Initial Investment + Purchases

Let’s look at the initial investment I made and how this increased in value over the span of the two months.

My initial investment was made in the form of purchasing multiple NFTs from the Psychedelic Anonymous (PA) collection. Remember, I was awarded a whitelist spot, which meant I was able to mint the NFTs from the collection. If you aren’t familiar with the term ‘mint’, it basically means you get early access to buy a projects NFTs when they first release them. Usually at a discounted price before they get listed on the secondary market where the general public can buy/sell them.

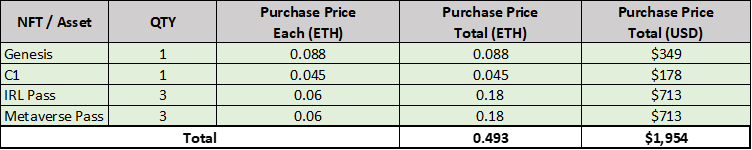

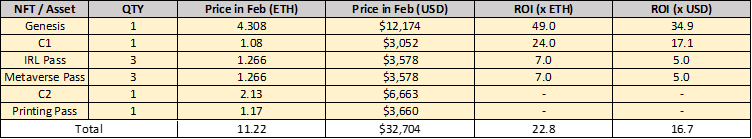

Below is a summary of my initial investment:

Date of Mint: 23rd December 2021

ETH Price: 1 ETH = $3,980 USD

At the time of mint, I minted 8 NFTs from the PA project for a total of 0.493 ETH, which at the time of purchase equated to a total of just under $2,000 USD ($1,954 to be exact). Each NFT has a different form of utility, which is why they differ in price and the QTY available.

The Rapid Growth Period

In the next two months after the initial mint release, the PA project gained an insane amount of popularity and interest in the NFT crypto space. This saw the price of the PA NFTs that I own skyrocket. And this was occurring all whilst the crypto market was entering a bear market and starting to drop significantly.

Towards the end of February, that’s when I started to see some major gains. This is where the craziness happens, so brace yourself.

DATE: 26th February 2022

ETH Price: 1 ETH = $2,826 USD

Let’s just take a quick moment to recognise just how much the Ethereum price dropped in the span of these two months. At the time of mint, ETH was just under $4,000 USD, however in February, it had dropped over $1,000 USD down to $2,826 USD.

So seeing as ETH had dropped by more than 30% in that two-month timeframe – you would think that my initial investments would have dropped in price as well, right?

Well, how wrong you are…

Knowing this makes what we’re about to uncover seem absolutely crazy. So have a glance over the table below, which summarizes the PA NFTs I held in the month of February and how much they were worth at that time. The USD prices shown factor in the 30% drop in ETH as well…

Just to summarize for you some of the key points that occurred in this two-month period:

- I purchased 8 NFTs for a total of 0.493 ETH

- This was equal to $1,954 USD at the time of purchase (December)

- 2 months later in February, my NFTs were worth 11.22 ETH

- This was equal to $32,704 USD at the time

- That’s a Return on Investment of 22.8 times the initial amount of ETH spent

- That’s a Return on Investment of 16.7 times the initial amount of USD spent

- Even though the price of Ethereum dropped by more than 30%, the price of the NFTs grew at a faster rate

- For reference, if the Ethereum price hadn’t decreased and instead maintained the same US dollar equivalent value of $3,980 in February as it did in December, my NFTs would have been worth more than $41,000 USD in February.

Before I comment further on these stats – you might be wondering why there are two extra NFTs listed in the table for February (the ‘C2’ and ‘Printing Pass’ NFTs). The reason traces back to something I said earlier – investing in the founders of NFT projects as opposed to NFTs themselves.

From the start, the founder of this project made it abundantly clear that they wanted to reward loyal members of the PA community. So one way that the founder was able to do this was by giving rewards to holders of their PA NFTs. These rewards included things such as free NFTs, merch drops or tickets to real life events etc.

In order to be one of these ‘loyal holders’ who received rewards, you needed to own a ‘full set’ of all the NFTs created by the project when it was first released.

To hold a ‘full set’ you needed to own the following NFTs:

- 1 x Genesis

- 1 x C1

- 1 x IRL Pass

- 1 x Metaverse Pass NFT

This is the reason why I minted multiple NFTs and not just one.

Purely for holding a full set, I got two free NFTs. This is exactly how I got the ‘C2’ and ‘Printing Pass’ NFTs you see listed in the table above.

If you hadn’t realised already from reading the table, these two NFTs were worth more than $10,000 USD combined.

Let me just repeat that to you… By simply owning a full PA set, I was essentially given $10,000 USD for free for doing absolutely nothing.

This is why I am still completely baffled by the amount of money that can be made by buying and selling jpeg images.

Take the Genesis NFT that I minted back in December for example. This jpeg image on its own was worth $12,000 USD in February, isn’t that crazy?!

The NFT crypto market is just completely bizarre!

It’s for this reason that it doesn’t surprise me why it’s so difficult for the general public to grasp and understand the concept of NFTs and how they work.

But regardless of how crazy, dumb or stupid, you may think they are, as is the case with all new technology – if you can become an early adopter and catch the hype train before it departs, then you can leverage that into an opportunity!

Your Exit Strategy Is Just As Important As Your Gains

So that right there is effectively how my $2,000 investment turned into $30,000 in the span of two months.

Those prices I showed you are from February, but I never sold my NFTs – I still have them.

That’s why I said this post is a bittersweet one. Although I could have sold out in February for $30,000 profit, I didn’t. I got sucked in thinking the price would keep increasing, but similarly, it didn’t.

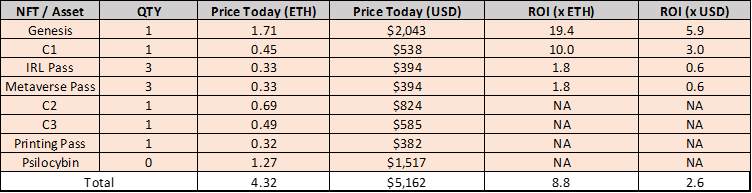

Instead, here’s what my PA NFTs are worth today.

DATE: 10th July 2022

ETH PRICE: 1 ETH = $ 1,195 USD

- I purchased 8 NFTs for a total of 0.493 ETH

-

- This was equal to $1,954 USD at the time of purchase

- Today, on July 10th my NFTs are worth 4.32 ETH

- This is equal to $5,162 USD at the time of writing

- That’s a Return on Investment of 8.8 times the initial amount of ETH spent

- However, since ETH has dropped majorly along with the rest of the crypto market, 1 ETH = $1,195 USD.

- This means that I currently have a ROI of 2.6 times the initial amount of USD spent

At the end of the day, A ROI of 2.6x in the span of 7 or so months is still incredible! However, when this could have been a ROI of 16.7x had I sold out at the right time, well it’s hard to shake that feeling.

That’s why it’s important to have an exit strategy in place. It’s one thing to earn high returns on your investments, but what’s the plan after that? If they’re crypto or NFT investments, will you leave them in the volatile state they are? Or will you look to convert them to stablecoins or some other assets that are less susceptible to price volatility?

I am not trying to tell you what to do. Instead, these are simply the questions you should be asking yourself. Take it from the guy who failed to ask himself these exact questions and missed out on cashing in on a 15x + gain!

The Future Of Psychedelic Anonymous

Fortunately for me, I do believe in the founders of Psychedelics Anonymous. In fact, that’s the reason I never sold out at the all-time highs.

And although it would have been nice to cash out at the highs and then buy back in at the lows, I still do have high hopes for the PA project and everything they have planned for the future.

The NFT crypto market is battling through a pretty bearish environment at the moment, a cycle of which is not new.

So in times like these, the best we can do is trust the fundamentals of the technology and wait for the downward trend to cease and reverse.

I look forward to seeing where the future of the Psychedelic Anonymous brand leads. With the metaverse becoming increasingly popular – who knows, maybe my initial $2,000 investment could someday increase to $100,000?

Either that or it goes to zero…

Either way, I’m in it for the long haul and excited to see how it pans out!

Thanks for sticking around!

– Nate