In this post, you will learn one of the easiest, set and forget strategies to invest into shares. This post will debunk the myths of the stock market and give you the confidence to start investing.

Welcome to Part 3 of my How To Invest guide – How To Invest Into Shares

This post is dedicated to talking about the easiest set-and-forget way to invest for the long term. It is a perfect investing for beginners guide.

First of all, there are many different ways you can invest your money.

But I’m writing this post from the perspective of someone who doesn’t have large amounts of capital to put down on the table.

I’m writing this from the perspective of someone who is cognisant of the long-term benefits of investing – someone who wants to lay down the foundation and reap the rewards, not tomorrow – but decades down the track.

That’s why in this post I will be focusing my attention towards investing into shares and the stock market. Specifically, a strategy that I use myself.

I’m focusing on investing into stocks because I believe it to be the most accessible option for beginners to start investing – especially for people like you and me who may not have the upfront capital to enter other investment opportunities such as the real estate market via means of purchasing a house.

But that doesn’t necessarily mean we can’t diversify our investment portfolios and enter the property investment market or other sectors, it just means we need to look at alternate means to enter.

Investing into shares gives people like you and me the opportunity to do exactly just this, as well as invest into hundreds of other sectors and industries.

Confronting The Stock Market

For anyone who is new to stock market investing, then investing into shares or choosing stocks to buy into can be a confronting and intimidating task.

The stigma associated with the stock market is often the reason why so many of us never even bother to learn about it in the first place.

However, buying shares and starting your investing journey is actually very easy – it’s choosing what to buy into and invest into that can be the challenging part.

You Don’t Have To Be A Day Trader To Start Investing Into Shares

Often blockbuster hit movies stereotype the stock market into something that only genius finance hotshots should bother with.

12 monitor screens, constantly monitoring charts, knowing every possible market influence, these are all just the unrealistic representations that movies falsify and lead us to think we have to do to be successful at investing.

In reality however, investing in the share market is much easier, requires less resources, and really doesn’t require much research at all.

Well, this is true if you’re investing for the long-term, where short-term market volatility is irrelevant to the long-term growth of your investment.

So let me now introduce you to an investing strategy that I and so many others take part in – known as Index Fund investing, or Exchange Traded Fund (ETF) investing.

What Is Index Fund Investing/ETF Investing?

An index fund is more or less no different to an ETF (more on this later). Both of these contain ‘bundles’ of shares contained within a single traded fund and offer low-cost, efficient diversification.

In other words, instead of hand-picking individual stocks to invest into (which would be ridiculously tedious, time-consuming and come with lots of trading fees), you are actually purchasing a percentage of all the stocks inside the index that the index fund is tracking.

Still not following? Well, let me put it this way – when you buy an index fund, you are essentially buying small pieces of many companies, sometimes on the order of hundreds or thousands depending on the index fund you buy.

For example, if you purchased shares of the Vanguard Total Stock Market (VTI) ETF, then you would be buying small pieces of over 4,000 companies. That’s because VTI tracks the performance of the Total US Market Index, so you get a small percentage of every stock listed on the US Market.

That’s why it’s such an efficient form of diversification.

That’s why it’s the easiest way to invest into shares.

It eliminates the need for you to choose what stocks to buy into.

Despite the simplicity of index funds/ETFs, there are still some nuances and terms to be aware of.

There are different types of index funds and ETFs, specifically how they are managed.

Of most importance, you might hear the terms mutual fund, passive fund, or active fund. So let’s delve a littler deeper into what each of these are so you are better equipped to make investment decisions.

The Difference Between An Index Fund, ETF And A Mutual Fund

Index Fund vs ETF

As I previously touched on, Index funds and ETFs are essentially the same things. In fact, I use these terms interchangeably.

Both track a particular market index or sector, such as the S&P 500. The only difference, however, is that you can purchase shares of ETFs on the stock market any time of the day (as long as it’s within market trading hours) just like you can with any other individual shares.

Index funds, however, can only be bought and sold for the price that is set at the end of the trading day.

Me personally, I purchase ETFs for this reason. But in the long run, either option should be inconsequential to your long-term returns.

Let’s face it, buying or selling an ETF at noon versus an Index Fund at 4 pm isn’t going to have that much of an effect on a 30-year investment.

Well… Unless you can somehow manage to perfectly time the exact moment a market is about to crash and reach its lowest. But if you can do that – well then, I’m sure you’ll be able to land yourself a job as a Wall Street analyst that will pay a hell of a lot more!).

Mutual Funds vs Index Funds/ETFs

So that’s ETFs and Index Funds separated, but what about mutual funds?

Index funds and mutual funds have many similarities. However the main difference is that an ETF is listed on a stock exchange, such as the Australian Securities Exchange (ASX) or the New York Stock Exchange (NYSE),

Mutual funds, on the other hand, are not generally listed on stock exchanges and are bought and sold through a variety of other channels — including financial professionals, brokerage firms, and directly from fund companies.

But other than how you buy mutual funds, the key difference between these types of funds compared to index funds and ETFs is how they are managed.

Mutual funds are managed by financial professionals who aim to outperform index funds. You might of heard the phrases ‘beat the market’ or ‘stock market performance’ thrown around before.

Basically, what this means is – is how the overall stock market performs over time.

And because index funds track the performance of an index or stock market, the performance of an index fund is tied to the performance of the stock market.

So, with that covered, mutual funds are managed by financial professionals who try to ‘beat the market’.

They do this by hand-picking stocks to buy, sell and trade at different times, based on their own research and forecasts of what stocks will perform or underperform.

What type of fund is better?

You may be thinking to yourself “well if a managed fund is managed by a professional who knows what they’re doing, then why would I choose an ETF/index funder over a managed fund?”.

This is a logical question to ask, because to most of us it seems obvious that this would be the way to go.

But, there are a few reasons why this may not be the best investment strategy for you.

You know that saying, ‘It’s too good to be true?’. Well, this can be applied to mutual funds, in a way.

Firstly. Fees.

The selling point of mutual funds is that they are managed by an analyst(s) who aims to outperform the stock market. They do this by hand-picking different stocks to buy, swap and sell based on how they anticipate the market will move. This is what is known as an ‘active’ fund management style, because it requires the fund operators to be active and consistently update the fund portfolio by buying or selling new stocks.

This requires a lot of hours put into researching by these analysts, so to mitigate the manual labour put into manually making these decisions, managed funds have high fees that customers have to pay for the services. A general rule in investing is that higher potential returns involve a higher risk. Mutual funds therefore typically come with higher risk because of the nature of trying to outperform the market.

Secondly. Outperforming the market consistently is incredibly difficult.

This topic deserves an entire post dedicated solely to talking about it, but just to summarise why it is so difficult, here are a few reasons:

- Every year, the S&P Dow Jones (a reputable market index) does a study on mutual funds. Last year, they found that after 10 years, 85 percent of large-cap mutual funds underperformed the S&P 500, and after 15 years, that percentage increased to nearly 92 percent. In other words, these financial professionals performed more poorly than the stock market, and charged more fees for it.

- Most professional-grade investors have access to the same data in real time and are able to use algorithms for immediate action. Outsmarting everyone or picking the hottest stocks first isn’t an easy feat because of this.

- The best-performing top 4% of stocks listed on the stock market generate the net gain for the entire stock market. So a few high-performing stocks pull the average up, while the majority of other stocks under-perform the market.

- Trying to hand pick stocks raises the odds that an investor will miss out on one of the top 4% of stocks that could propel its returns high enough to beat the market.

- For example – if four different stocks return 10%, and one stock returns 50%, the overall market performance is 18%. But any portfolio without the one good stock that returned 50% would underperform the overall market performance.

- Statistically, you are at a disadvantage trying to hand-pick stocks that will ‘outperform’ the market.

There are many finance-related books on this topic, so if you are eager to learn more about the principles of investing and trying to outperform the market, I recommend you check out my post on the Top 5 Best Finance Books You Must Read, and focus your attention on “The Intelligent Investor, by Benjamin Graham”.

For the two reasons discussed above, I won’t be discussing mutual funds any further in this post, because personally I don’t invest into them. I prefer to be in control of where my investments are going. That’s not to say you shouldn’t invest in mutual funds, but personally, I cannot comment on which mutual funds I like or have invested into, because I never have. That type of financial advice needs to come from a trained professional.

How Much Does It Cost To Invest In Index Funds/ETFs?

Cost Of Owning An Index Fund/ETF

The benefit of index funds and ETFs are that they are low-cost. Most index funds or ETFs are what we call ‘passive’. Passive funds are named so because that is exactly what they are, passive. They have no manager who actively monitors, buys, swaps, or sells stocks within the portfolio.

Instead, passive funds seek to replicate the performance of a broader equity market, sector or trend (such as the ASX 200 or S&P 500).

Because there is no extra work required by an index fund/ETF provider to pick, buy and sell stocks, the management fees are very cheap, usually on the order of <0.5%.

Minimum buy in amounts

Sometimes when purchasing stocks to invest into, you are required to buy an amount that is worth more than what is known as the ‘minimum buy-in’ amount.

The minimum buy-in amount is very dependent on the fund you are purchasing. Some funds will have a minimum buy-in amount of $2000, $5000 or more. Whereas others may not have a minimum buy-in amount at all.

Typically index funds have higher minimum buy-in amounts compared to ETFs, which is another reason why I like ETFs. But as an example for the ETFs I own, the minimum buy-in amount is on average $500, which is common for most securities here in Australia listed on the ASX. It’s important to note that after you have purchased an initial $500 of a particular stock on the ASX, the minimum buy-in amount is no longer applicable for that stock or ETF, so you can make future purchases of any amount you desire after that initial first purchase, eg. adding another $150 into it etc.

If you’re in the US, however, there are many ETFs that do not require minimum buy-in amounts and are instead only limited to the minimum buy-in amount set by the brokerage platform you are using to buy stocks.

Typical Returns You Could Expect

Index funds and ETFs track the performance of a particular market index. For this reason, their performance is tied to the overall performance of the market index it is tracking.

For example, the two main market indexes that my ETFs track are split between Australian Investments (since I live in Australia) and US investments (since they constitute the world’s largest indices based on market capitalization).

Now, if we look over the past century, then the average stock market return comes out to be about 8-10% per year (as measured by the S&P 500 index).

It’s important to note that this figure is an average. In some years, the market returns more than that, and in other years it returns less.

Although 10% may not appear like much, over a long-term period, this can result in massive returns.

That’s because the power of index fund/ETF investing is the culmination of two factors (1) time and (2) compound interest.

I’ve discussed compound interest in many of my posts already, so if you’re new to the concept, you should read my previous post which describes it in detail: What Is Compound Interest?

To summarise it for convenience, compound interest is the interest that is earned on your principal amount (initial investment), plus the accumulated interest that is earned from previous periods.

It means you are earning interest on top of interest, and this propagated out to a long-term period exponentially increases your investment.

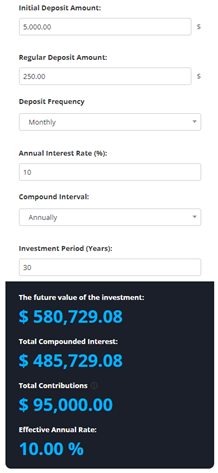

I’ve added a screenshot of a compound interest calculation I’ve completed (you can try out the compound interest calculator in the same post that describes what compound interest is!).

If we consider a 30-year time period – for an initial principal/deposit amount of $5,000, followed by regular monthly contributions of $250, you will have contributed a total of $95,000 over that 30 year period.

But the total amount your investment increases to over that same 30-year period is a staggering $580,000.

That’s all because of compound interest.

This is exactly why ‘time in the market’ beats trying to ‘time the market’ (which requires picking the best times to buy and sell stocks, which is almost impossible to do consistently).

A List Of Popular ETFs

By now you have developed a sense of what an index fund/ETF is, how they work, and how much your your investment could expect to return. So you are probably wondering “what ETFs are out there?”. So to give you an idea, I’ve compiled a list of some of the most popular ETFs commonly talked about in the investing world.

This is just a list of popular ETFs, it is by no means financial advice! You should always seek independent advice from a trained professional before making any financial decisions!

Popular Australian ETFs

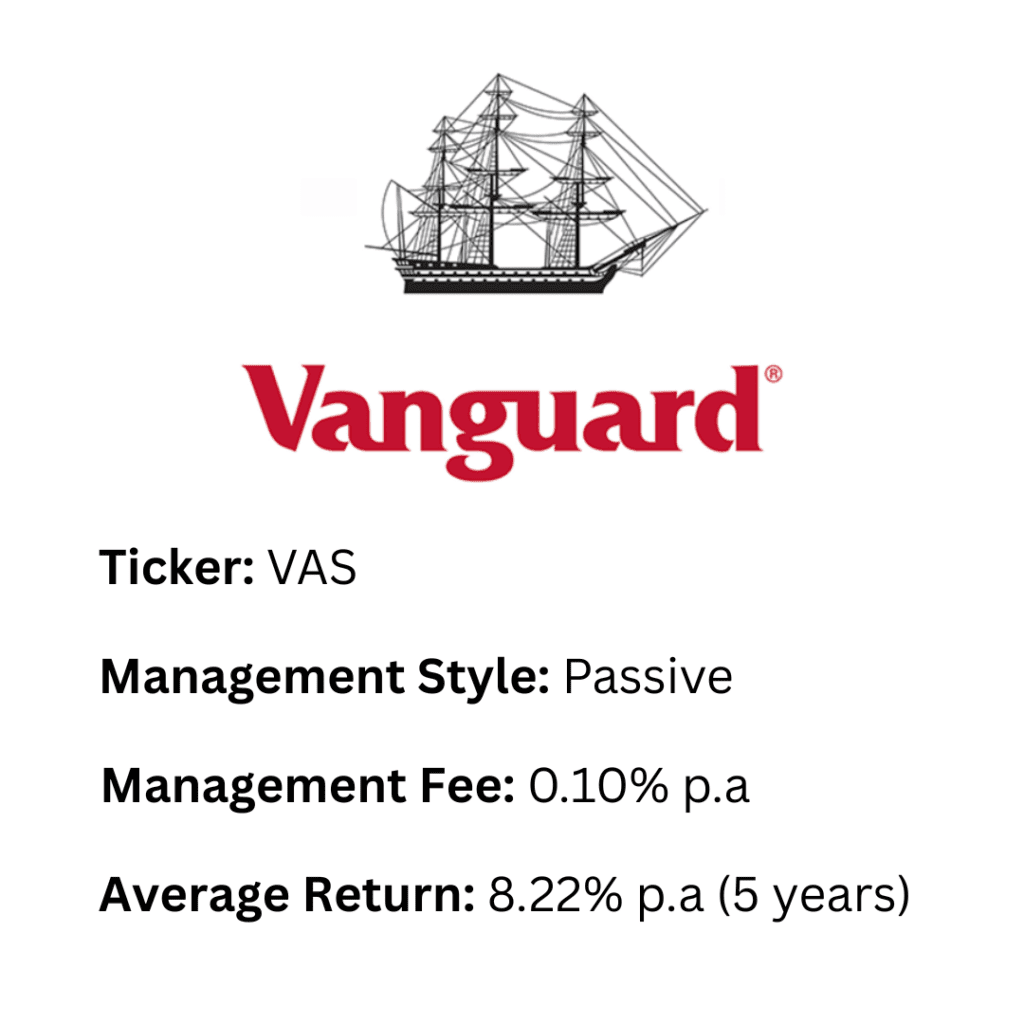

Vanguard Australian Shares Index ETF (VAS)

The ETF provides low-cost, broadly diversified exposure to Australian companies and property trusts listed on the Australian Securities Exchange. The fund seeks to track the return of the S&P/ASX 300 Index.

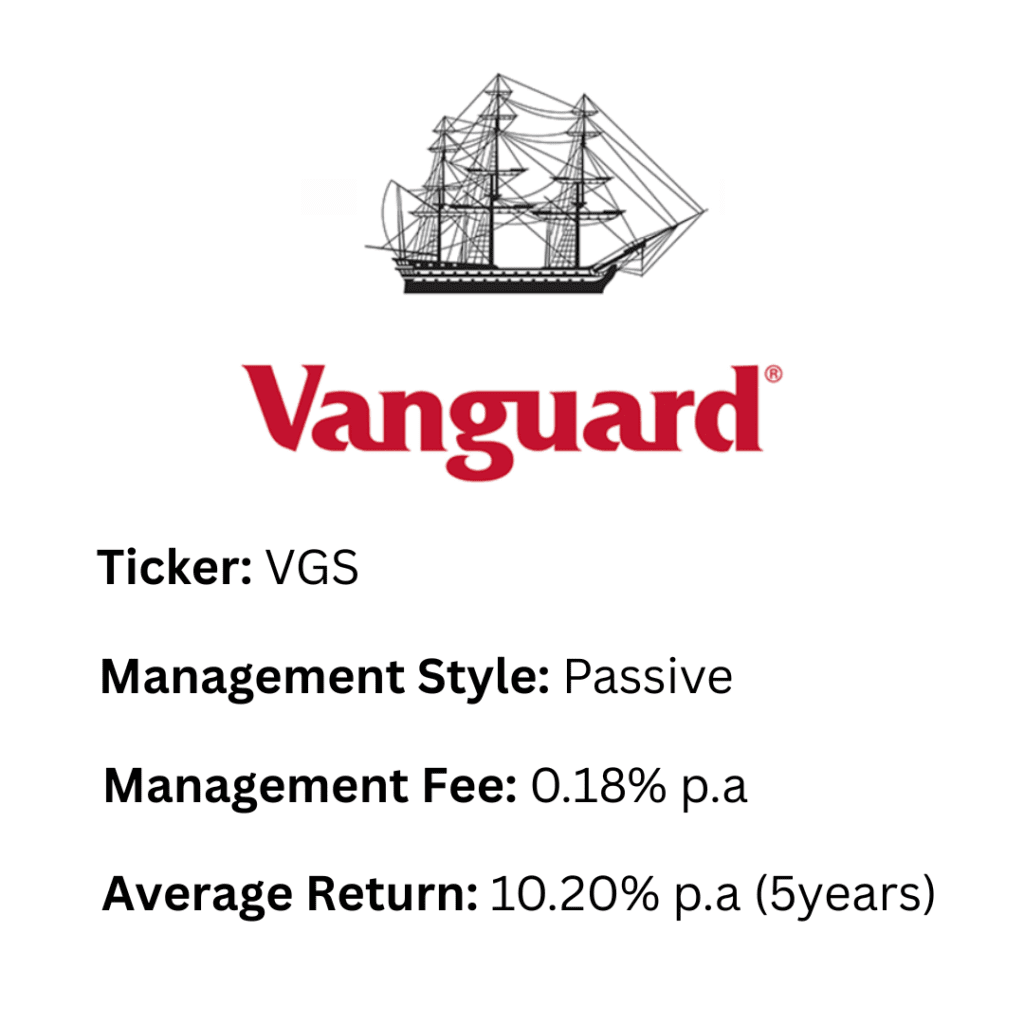

Vanguard MSCI Index International Shares ETF (VGS)

This ETF seeks to track the return of the MSCI World ex-Australia (with net dividends reinvested). This fund focuses on international investments, which helps to diversify your portfolio!

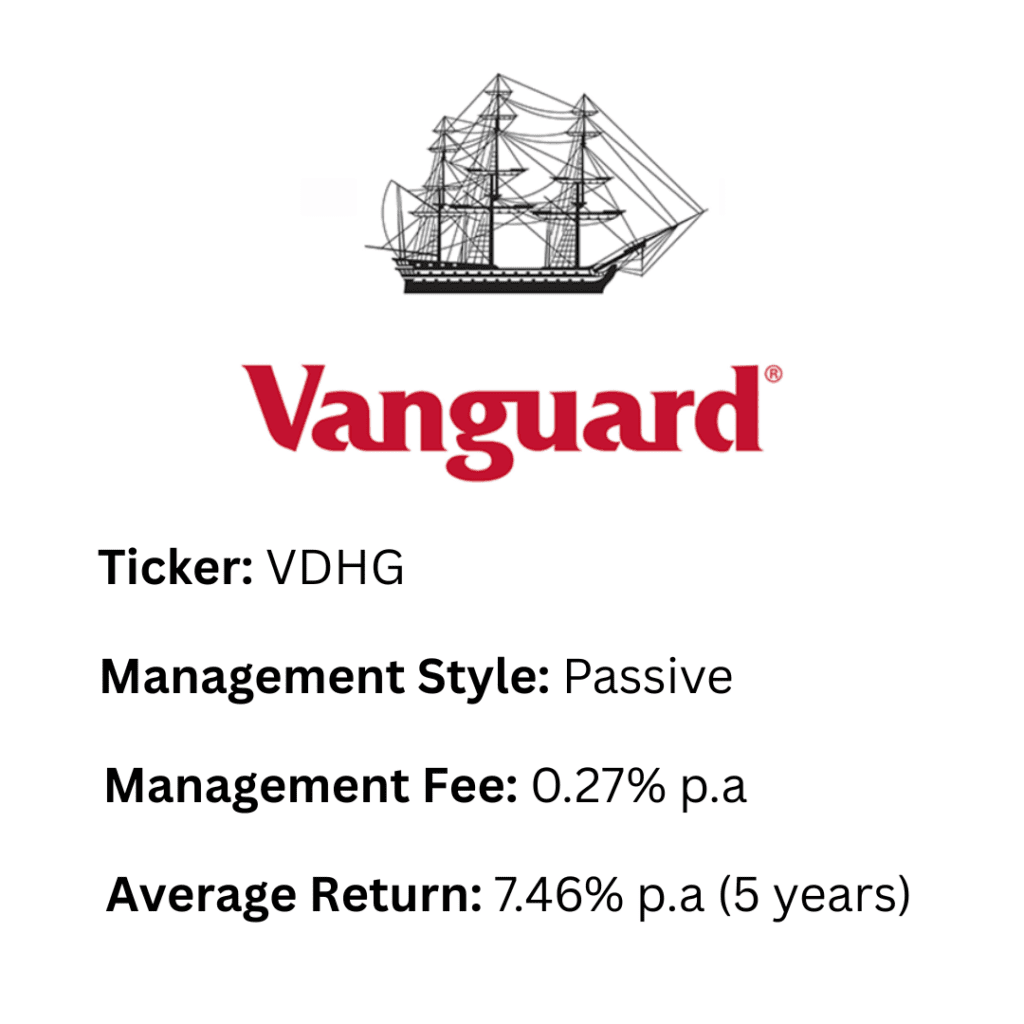

Vanguard Diversified High Growth Index ETF (VDHG)

This ETF seeks to track the weighted average return of the various indices of the underlying funds in which it invests. This ETF is actually comprised of several other ETFs. Specifcially, the Vanguard Australian Shares Index ETF (ASX: VAS) and the Vanguard MSCI Index International Shares ETF (ASX: VGS). It also has smaller weightings in Vanguard funds across small companies, emerging markets, and bonds. By having multiple ETFs inside this fund, it is an extremely diverse investment option with lower investment risk. Because of this, it tends to return slightly less than the higher-risk, higher-growth VAS and VGS funds.

Popular US ETFs

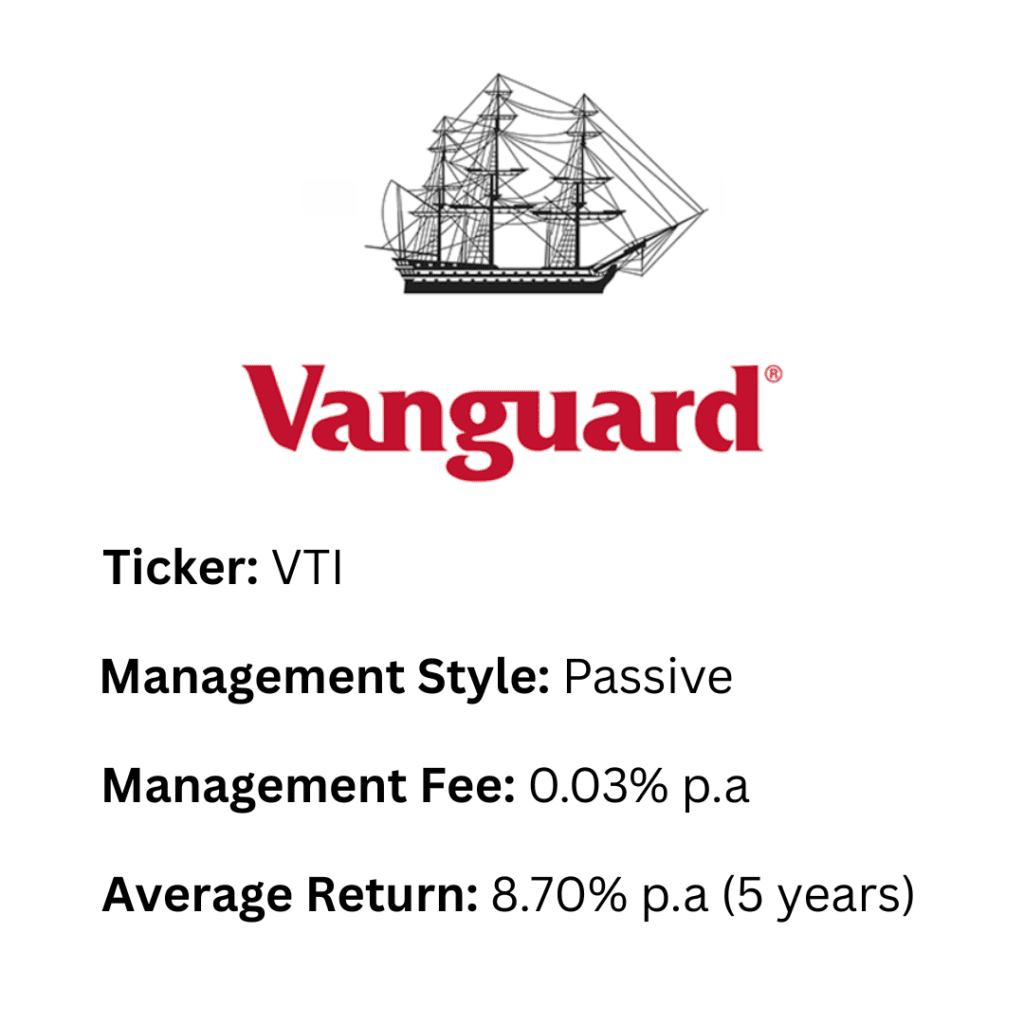

Vanguard Total Stock Market ETF (VTI)

This ETF seeks to track the investment performance of the US Total Market Index, which represents approximately 100% of the investable U.S. stock market and includes large-, mid-, small-, and micro-cap stocks regularly traded on the New York Stock Exchange and Nasdaq.

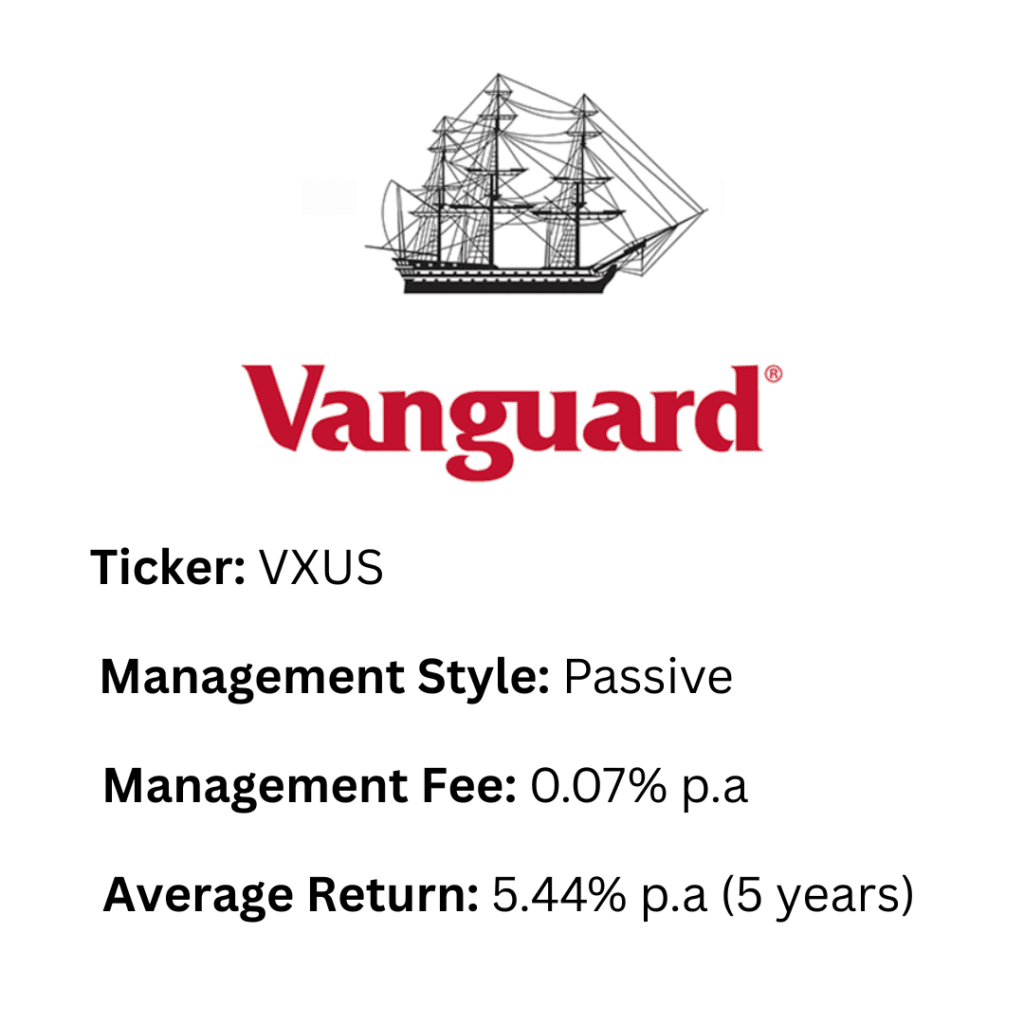

Vanguard Total International Stock ETF (VXUS)

This ETF seeks to track the investment performance of the FTSE Global All Cap ex US Index, an index designed to measure equity market performance in developed and emerging markets, excluding the United States. This fund diversifies your portfolio into international markets outside of the US.

Key Takeaways

I hope this post helped demonstrate how anyone can invest into shares without being a financial genius! I know it is a very daunting concept to grasp at first, but my goal in this post was to hopefully reduce some of those anxieties you may have had when it comes to understanding the stock market.

You don’t need large amounts of captial to get started, instead just consistency! Little contributions over time can turn into remarkable outcomes, so let that be the message you take out from this post!

I’ll end this post with some of the key takeaways we discussed, enjoy!

- Index funds/ETFs allow you to own a portion of hundreds or thousands of companies in a single trade.

- Index funds/ETFs can instantly create a diversified portfolio since they invest in various sectors and assets.

- Index funds/ETFs can be either passively or actively managed.

- Passive Index funds/ETFs track the performance of the market, they have low fees because a fund manager is not required to do any extra work.

- Active Index funds/ETFs require a fund manager who actively buys, sells and swaps stocks in and out of the fund, hence come with higher management fees.

- The performance of index funds/ETFs is tied to the stock market index it is tracking. On average, the stock market returns 8-10% when assessed over a long-term period. So you could expect similar returns from an index fund/ETF.

Disclaimer:

Investing always involves a level of risk. You aren’t guaranteed to make money, and it is possible to lose the money you start with. The author is not a financial advisor, so neither the author nor the publication takes any responsibility or liability for any investments, profits or losses you may incur as a result of this information. This content is intended for general informational and educational purposes only and may contain affiliate links. You should consider seeking independent legal, financial, taxation or other advice when considering whether an investment is appropriate for your objectives, financial situation or needs.

Pingback: A Beginners Guide On How To Start Investing | Trajectory To Wealth

Pingback: Dollar Cost Averaging: The Ultimate Strategy For Successful Investing