🎉 Special Offer: ING High-Yield Savings Account Promotion 🎉

Thinking of opening a savings account? Do it today with ING and get a $125 bonus! All you need to do is use the promo code Hxj481 when you sign up here and follow the steps to meet the eligibility criteria.

Curious about the details?

Keep reading to find out more!

Howdy! If you’re looking to open a savings account that offers a high yield savings rate and provides you a $125 bonus for signing up, then read on to learn more about ING Australia.

What is ING and their high-yield savings account?

For those who might not be familiar, ING is a well-established global banking company with a strong presence in Australia. They offer a variety of financial products and services designed to cater to our unique needs Down Under.

One of their flagship products is the ING high-yield savings account. This account is specifically designed for Australians and offers a fantastic opportunity to earn an impressive 5.5% interest on your savings. With such a high interest rate, you can grow your wealth at an accelerated pace, putting you on the fast track to achieving financial independence.

The best part is that it’s completely free! There are no bank fees associated with opening up an ING high-yield savings account, and if you make use of my referral link to sign up, we’ll both bag $125 each as a bonus.

Why open an ING high-yield savings account?

There are plenty of reasons why opening an ING high-yield savings account is a smart move for Australians looking to grow their wealth faster. Let’s take a closer look at some of the key features and benefits that make this account stand out:

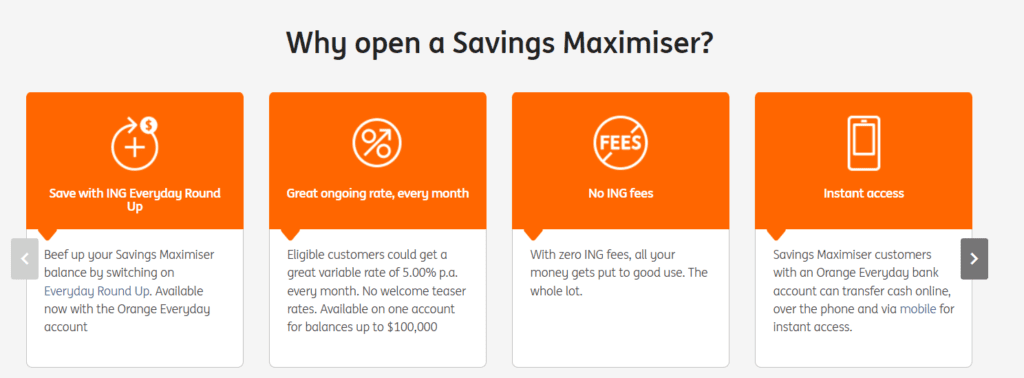

Save with ING Everyday Round Up: By linking your ING high-yield savings account with an Orange Everyday account, you can take advantage of the Everyday Round Up feature. This innovative tool allows you to round up your everyday transactions and automatically transfer the difference to your savings account, making it easier than ever to grow your savings without even noticing.

Great ongoing rate, every month: Unlike many other banks that offer temporary “teaser” rates, ING provides eligible customers a fantastic variable rate of 5.50% p.a. every month. And this rate is available on one account for balances up to $100,000, ensuring your money is consistently working harder for you.

No ING fees: With zero ING fees on your high-yield savings account, you can be confident that every dollar you save is being put to good use. That means no account maintenance fees or transaction fees to worry about, so you can focus on growing your wealth.

Instant access: For those who value flexibility and convenience, ING high-yield savings account customers with an Orange Everyday bank account can enjoy instant access to their savings. You can easily transfer cash online, over the phone, or via mobile whenever you need it, giving you the freedom to manage your finances on your terms.

These features make ING’s high-yield savings account an attractive option for Australians looking to accelerate their wealth-building journey. So why not give it a try and see how it can transform your savings strategy?

Eligibility criteria to earn 5.5% with ING high-yield savings account

Great news for savers! ING has increased their interest rate from 5% to a whopping 5.5%. That means more savings for you! If you thought the deal was sweet before, it just got sweeter. Take advantage of this higher rate and watch your savings grow even faster.

Now that you know about this opportunity, you might be wondering what it takes to qualify for the 5.5% interest rate with ING’s high-yield savings account. Well, there are a few eligibility criteria you need to meet consistently to maximise your interest earnings:

Be an Australian resident: This account is exclusively for Australians, so you’ll need to provide proof of residency to open and maintain the account.

Deposit a minimum amount monthly: To qualify for the 5.5% interest rate, you’ll need to deposit a $1000 into your account each month. This amount may vary, so be sure to check the latest requirements on ING’s website.

Make a set number of transactions: You’ll also need to make 5 transactions using your linked ING transaction account each month. This encourages active use of your account and helps you develop good financial habits.

Grow your savings: To be eligible for the 5.5% interest boost, you need to grow your high-yield saving account balance each month. For example, if your last month balance was $5,000, you would need to grow it to $5,001 in that month to meet the eligibility criteria.

Maintain a maximum account balance: Keep in mind that there’s a cap on the account balance that can earn the 5.5% interest rate. Balances exceeding $100,000 will earn a lower rate, so it’s essential to be aware of this restriction.

By meeting these criteria consistently, you’ll be able to enjoy the full benefits of the 5% interest rate and grow your wealth at an impressive pace.

How to open an ING high-yield savings account

Opening an ING high-yield savings account is a straightforward process for us Aussies. Here’s a step-by-step guide to help you get started:

Visit the ING website: Head over to the ING Australia website and navigate to the high-yield savings account product page.

Click ‘Open Now’: Once you’re on the product page, you’ll see an ‘Open Now’ button. Click on it to begin the application process. If you use this link which contains my referral code, then you will receive a bonus $125 if you meet the eligibility criteria.

Provide personal information: You’ll need to enter some basic personal information, such as your name, address, phone number, and email address.

Verify your identity: ING will require you to verify your identity using a valid Australian ID, like a driver’s license, passport, or Medicare card.

Link your transaction account: To make the most of your high-yield savings account, you’ll need to link it to an ING transaction account. If you don’t have one already, you can open one during the application process.

Review and submit your application: Double-check all the information you’ve provided, and submit your application. ING will review your application and, if approved, you’ll receive a confirmation email with your account details.

And there you have it! With just a few simple steps, you’ll be on your way to unlocking the earning potential of ING’s high-yield savings account.

Maximizing your savings with ING

Now that you’ve got your ING high-yield savings account set up, it’s time to make the most of it and grow your wealth. Here are a few tips to help you maximize your savings:

Allocate a portion of your income: Consistently deposit a portion of your income into your ING account each month. This can be a fixed amount or a percentage of your earnings, depending on your financial goals and comfort level.

Set up automatic transfers: To ensure you’re always meeting the monthly deposit requirement, consider setting up automatic transfers from your transaction account to your savings account. This way, you’ll never forget to make a deposit, and you’ll always qualify for the 5.5% interest rate.

Take advantage of compound interest: The magic of compound interest is that the interest you earn on your savings also earns interest over time. The more you save, and the longer you leave your money in your ING account, the more your wealth will grow. Still not sure what I mean by compound interest? Well don’t worry, this post will explain everything you need to know about compound interest!

Review your savings strategy: Periodically evaluate your savings strategy and make adjustments as needed. This could involve increasing your monthly deposits or changing your financial goals as your circumstances evolve. If you need a personalised money tracker to help with this, I have a free personal finance spreadsheet that you can download for free! Check out the personal finance spreadsheet here!

By following these tips, you’ll be well on your way to maximizing the earning potential of your ING high-yield savings account and accelerating your journey to financial independence.

Closing thoughts and personal experiences

Using the ING high-yield savings account has been an incredible journey for me. Since opening my account, I’ve seen my savings grow at an unprecedented pace, putting me closer to my financial independence goals.

The 5% interest rate offered by ING has made a significant difference in my savings strategy. It’s motivated me to consistently save more and develop better financial habits. And the best part is that it’s specifically designed for us Australians, making it a perfect fit for our unique financial landscape.

I genuinely believe that this high-yield savings account can be a game-changer for anyone looking to accelerate their wealth-building journey. So, if you’re an Australian seeking an effective way to grow your wealth faster, I highly encourage you to explore the potential of ING’s high-yield savings account. Give it a try and see the difference it can make in your life.

Remember, the path to financial independence is a journey filled with ups and downs. But with the right tools, strategies, and mindset, you can reach your goals and live the life you’ve always dreamt of.

That’s it for this post! If you have any questions or experiences you’d like to share, feel free to leave a comment below. I’d love to hear your thoughts. Happy saving!

📢 Reminder: Don't Miss Out on the $125 Bonus Offer! 📢

Want to make the most of this special promo deal? Here’s what you need to do:

- Open an Orange Everyday account using this official ING link and enter the promo code Hxj481 at the end of the online form (if it isn’t entered automatically).

- Deposit $1,000+ from an external source into your new Orange Everyday account within any calendar month.

- Make 5+ settled purchases using your new Orange Everyday card within any calendar month.

- Open a Savings Maximiser (if you don’t have one already) and deposit any amount into it.

You can also access the same promotional code as well as many other referral codes within this spreadsheet – it has a bunch of deals and promos that can earn you some generous sign-up bonuses! Or head on over to this Reddit post of mine. If my code doesn’t work for whatever reason, you can look through the comments and try another!