Learn the fundamental concepts behind cryptocurrency – what it is, how it works, and why it is one of the fastest-growing digital asset classes in history

Cryptocurrency can often seem like a complex and challenging concept to grasp, and although it may be true that the underlying technology behind cryptocurrency is sophisticated and complex – understanding what it is and how it works is not actually that difficult. My thought (like it is with a surprisingly large number of concepts) is that it’s the stigma associated with the technology that is the most difficult part to crack. Getting over those pre-existing biases of thinking it is too complicated of a topic to understand, or that it is a ‘scammy’ waste of time, and instead actually taking the time to delve a little bit deeper and conduct some research is the first step to understanding the technology.

That’s the focus of this article – bringing together the basics of cryptocurrency into a single place, such that you don’t need to strain yourself over where to look and what to research to learn more about the technology. I will cover what cryptocurrency is, how it works and provide you with the relevant information for you to decide whether this technology may be within your investing-appetite.

What Is Cryptocurrency?

Cryptocurrencies are an emerging type of asset class consisting of digital or ‘virtual’ tokens. These digital tokens do not exist physically as coins or notes like traditional money does and are instead stored in a digital “wallet”. This allows people to make payments directly to each other through an online system.

To fully understand what cryptocurrency is, we need to first understand three core terminologies – cryptography, decentralization and blockchain.

Understanding The ‘Crypto’ Part Of ‘Cryptocurrency’.

The backbone of cryptocurrency is built upon a technology called ‘cryptography’, which is a method of verifying and securing data using complex mathematical algorithms.

In the most simplest of terms, cryptography is a technique to send secure messages between two or more participants. The sender encrypts/hides a message using a type of key and algorithm before sending the encrypted message to a recipient. The recipient then decrypts the message from the sender using encryption keys to generate the original message.

Encryption keys are the most important aspect of cryptography. They make a message, transaction, or data value unreadable for an unauthorized reader or recipient, and it can be read and processed only by the intended recipient. Keys make the information ‘crypto’, or secret.

Cryptography methods use advanced mathematical codes to store and transmit data values in a secure format that ensures only those for whom the data or transaction is intended can receive, read, and process the data, and ensure the authenticity of the transaction and participant, just like a real-world signature.

What Is Decentralization?

When we talk about money, we usually refer to cold-hard cash or money that is stored in our everyday bank/savings accounts. This form of money is governed by authorities like reserve banks and is referred to as centralized money. Basically, it means that one entity can have full control.

Cryptocurrency on the other hand, is not a centralized form of money. Instead, it is decentralized. Decentralized currency, also known as digital currency or peer-to-peer money, refers to bank-free methods of transferring wealth or ownership of a commodity without needing a third party. Decentralization in cryptocurrency effectively aims to remove control and decision-making processes from a centralized entity (such as banks) to a distributed network. The point of this, is to reduce the level of trust that participants must place in one another, and deter their ability to exert authority or control over one another in ways that degrade the functionality of the network.

What Is Blockchain Technology?

Cryptocurrency is built upon a technology known as the blockchain, which is essentially a record of all transactions made by currency holders.

Units of cryptocurrency are created through a process called mining, which involves using computer power to solve complicated mathematical problems that generate coins.

If you own cryptocurrency, you don’t own anything tangible. What you own is a key that allows you to move a record or a unit of measure from one person to another without a trusted third party.

The cryptocurrency transaction is then encrypted and broadcast to the network to be recorded on the blockchain. They are recorded on the blockchain ledger through a process called “mining”.

Crypto Mining 101

Cryptocurrency mining is a process that uses computers from around the world to solve complex mathematical problems in order to verify transactions. The miner who solves the problem is compensated with a certain amount of the coin they are mining. This is known as the block reward. To understand mining, we need to understand blockchain technology.

How The Blockchain Functions

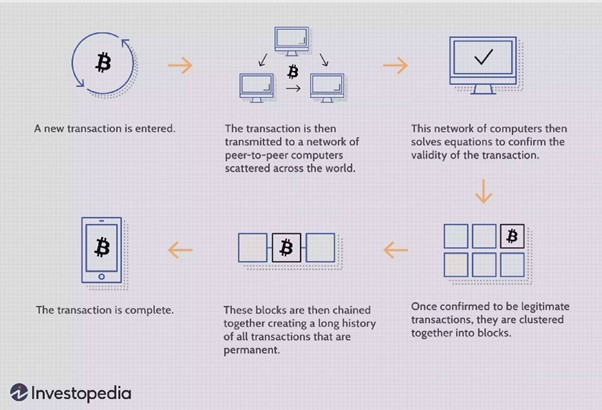

Blockchain technology is the technology that enables cryptocurrency to exist. Essentially, a blockchain is a distributed database of transactions that are immutable (cannot be changed) and shared among ‘nodes’ (thousands of computers) spread across a computer network (in this case, the world). Each node acts as a validator to update and verify that each transaction made on the blockchain is legitimate. The process of how the blockchain works to validate a transaction is best summarised by the image below from Investopedia

Every time a transaction is confirmed to be legitimate by a network of computer nodes, it is clustered together into a new block(s) on the blockchain. In essence, the goal of blockchain technology is to record and distribute digital information, but most importantly, not to allow it to be changed or edited. Because of this, blockchain technology (also known as immutable ledgers) is basically records of permanent transactions (blocks) that cannot be altered, deleted, or destroyed.

Blockchain is a powerful technology because each block is duplicated and distributed to every node on the decentralized network for verification, which removes the need for a trusted third party, such as a central bank. It also makes it virtually impossible to create false or counterfeit transactions.

When did cryptocurrency start?

In wake of the global financial crisis, an anonymous developer, known as Satoshi Nakamoto, created the first-ever cryptocurrency in 2009. That’s right, you guessed it, Bitcoin. It’s because of this that people without any knowledge or understanding of cryptocurrency often think the words cryptocurrency and Bitcoin are synonymous with each other, even though Bitcoin is just one of many thousands of cryptocurrencies that exist. The intention was to create a global, decentralized digital currency that was separate from the traditional banking system, which was largely responsible for the worldwide economic recession in 2008.

Over the next few years, traction grew for the blockchain technology on which Bitcoin was created on. Others started to see the potential for this technology, which in 2011, saw the first cryptocurrencies besides Bitcoin start to emerge. This served to have a ripple effect when other developers and investors began to see that cryptocurrency and blockchain technology had the potential to create huge amounts of money to be made from investing in and/or trading crypto. And that’s how the cryptocurrency market of almost 20,000 coins that we have today was born!

DID YOU KNOW

Still to this day, the identity of Satoshi Nakamoto is still unknown. It is unclear whether it was a sole individual developer or a group of developers responsible for creating the first ever cryptocurrency (Bitcoin).

Crypto - Is It The Future?

In the decade or so that cryptocurrency has been around, it has already showed significant promise for innovation in areas such as finance, investing, gaming, cloud storage & security, and even in the arts. The decentralized nature of the technology is opening up countless opportunity and cutting out unnecessary third-parties whom act as middle-men. For this reason, many people are aspiring to be early adopters of the revolutionary technology such that they can reap the rewards as it develops into the future.

Reducing Transaction Fees

Crypto is gaining popularity all around the world because it is often cheap to use. Other forms of online payments, particularly sending money internationally, can be expensive as there are often large fees attached to these transactions. But with cryptocurrency, you can make everyday transactions or send large sums of money worldwide on the cheap, regardless of the total value.

High-Risk High-Reward

Although cryptocurrency has been increasing in adoption worldwide, there have been several large crashes as well. In 2014-2015, the crypto market crashed by more than 80%. In the three years proceeding the crash, the market recovered by more than a staggering 25,000%. However, towards the end of 2018, another crash occured which saw the market plumet again by more than 80%. And just like history repeating itself, the market had proceeded to recover again leading up to the end of 2021. But now, as I write this in mid-2022, we are seeing yet another crash of the crypto market.

So although history has shown us the market has always bounced back stronger than ever after a crash, it’s vital to remember that history or past performances are not an indicator or guarantee of future performance. No matter how promising the crypto project is you are investing in, there are absolutely no guarantees it won’t suddenly crash. So be careful, be vigilant and always make sure that you do your own thorough research before buying or investing in crypto.

How Can You Buy Cryptocurrency

There are multiple ways you can buy cryptocurrencies. The easiest approach for beginners, however, is to use a cryptocurrency exchange. A cryptocurrency exchange essentially allows you to deposit fiat currency (USD or AUD for example) into an online account that can be swapped for cryptocurrencies of your choice. Once you have your crypto assets, it is stored on the exchange where you can sell it at a later time. You can also transfer your crypto to other wallets if you plan to hold it long-term or send it to a friend for example.

You’ll probably have seen from all the sporting advertisements and mainstream media that there are hundreds of crypto exchanges out there that enable you to buy, swap and sell hundreds of different kinds of cryptocurrency coins. Because of this, there are lots of exchanges out there to pick from. There is no one right answer as to which exchange is best, as it depends on your specific needs and objectives. However, for me personally, when I first started out there are the two exchanges I used the most:

- Coinbase – A beginner-friendly exchange where you can learn about new cryptocurrencies and get paid for it!

- Swyftx – my exchange of choice for Australians that pays you rewards for holding specific types of cryptocurrencies

Conclusion

This article was created to provide you with an introduction to cryptocurrency and blockchain technology. If you would like to learn more about any of the topics or concepts discussed in this article, subscribe below for future posts and updates!

Cheers,

– Nate

Disclaimer:

Investing always involves a level of risk. You aren’t guaranteed to make money, and it is possible to lose the money you start with. The author is not a financial advisor, so neither the author nor the publication takes any responsibility or liability for any investments, profits or losses you may incur as a result of this information. This content is intended for general informational and educational purposes only and may contain affiliate links. You should consider seeking independent legal, financial, taxation or other advice when considering whether an investment is appropriate for your objectives, financial situation or needs.