Saving money is a cornerstone of achieving financial stability and paving the way towards fulfilling both short-term and long-term goals. However, without a clear roadmap, saving can feel like a daunting task. This is where a saving goals worksheet comes into play, offering a structured approach to setting, tracking, and achieving your financial objectives.

- Financial Goals Worksheet: A valuable tool to streamline your financial planning, offering structure and clarity.

- Types of Worksheets: Various worksheets cater to different saving objectives, allowing you to tailor your approach.

- Online Resources: Embrace digital tools to simplify tracking your financial goals effectively.

- Real-life Applications: Discover how savings goals worksheets can be practically useful in your financial journey.

Understanding the Importance of Savings Goals

Embarking on a savings journey without a plan is akin to sailing without a compass. It’s easy to drift off course and lose sight of your goals. This is where the financial goals worksheet shines as your financial compass, guiding you towards well-defined short-term and long-term goals.

Benefits of Using a Savings Goals Worksheet

Utilizing a savings goals worksheet is akin to having a financial roadmap. Here are some compelling advantages:

- Visualization: Visualization: Having your goals laid out on paper or a digital platform makes them tangible, creating a clear vision of what you are working towards.

- Motivation: Tracking your progress instills a sense of accomplishment and motivates you to stay on course.

- Organization: It keeps your financial goals organized, providing a clear view of where you stand.

- Adjustment: Easily adjust your saving plan in response to changes in your financial circumstances.

Understanding SMART Goals

When embarking on a financial journey, it’s crucial to set clear and achievable targets. This is where SMART goals come into play, providing a robust framework for goal setting. The acronym stands for:

- Specific: Clearly define what you want to achieve.

- Measurable: Ensure your goal can be tracked and measured.

- Achievable: Your goal should challenge you, but still be attainable.

- Relevant: Ensure the goal is pertinent to your financial life.

- Time-bound: Set a realistic deadline to achieve your goal.

For a deeper dive into SMART goals and a toolkit to assist you in setting and achieving your financial objectives, explore the Consumer Financial Protection Bureau Toolkit. This valuable resource offers practical guidance and tools to align your financial goals with the SMART framework.

This methodology is particularly useful in the context of financial goals, as it encourages a disciplined, well-structured approach towards achieving desired outcomes. It complements the utility of a savings goals worksheet, which acts as a tool to document, track, and adjust your goals based on this SMART framework.

With the SMART principles in mind, our next step is to delve into the different types of savings goals worksheets available, which can help in effectively managing your short-term and long-term financial objectives.

Types of Savings Goals Worksheets

Different savings goals necessitate different types of worksheets. Here’s a simplified categorization:

- General Savings Worksheets: Tailored to any saving goal, whether it’s building an emergency fund or saving for a vacation.

- Specific Savings Worksheets: Designed for particular goals such as saving for a house down payment or creating a retirement savings plan.

| Type of Worksheet | Goal | Features |

|---|---|---|

| General Savings Worksheet | Emergency fund, Vacation | Customizable, Versatile |

| Specific Savings Worksheet | House down payment, Retirement | Goal-specific, Detailed |

These worksheets play a crucial role in breaking down your long-term goals into manageable monthly goals, making the process less daunting and more achievable.

If you’re looking for a user-friendly budget worksheet to kickstart your savings journey, consider using the OppU Budget Worksheet. This worksheet is tailored for general savings goals and can assist you in creating a solid financial plan

Harnessing Online Resources and Tools

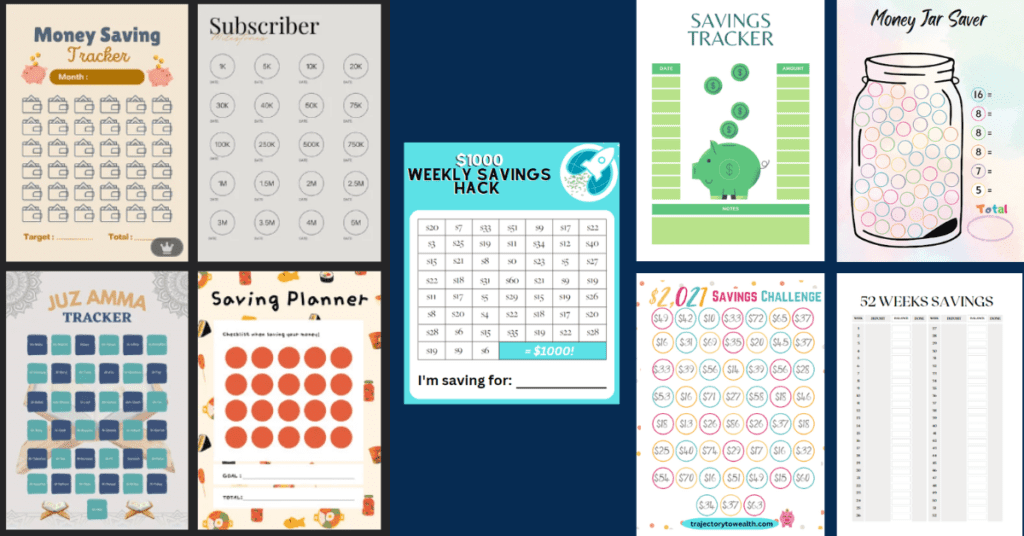

In the digital era, a plethora of online tools and resources are available for creating and tracking savings goals. These tools enhance the traditional financial goals worksheet, offering a blend of convenience and functionality. One online resource is the Etsy Saving Goals Worksheet I created. This adds a layer of fun to your savings goals, making it easier to stick to.

Furthermore, there are numerous applications and software tailored for budgeting and savings tracking:

- Budgeting Apps: These apps provide a holistic view of your finances, helping manage your credit cards, credit score, and save towards your monthly goals.

- Online Saving Goal Trackers: Specialized tools to help set, track, and achieve your savings goals with features like goal setting, reminders, and progress visualization.

- Customized Guidance: For a more personalized approach to managing your finances, explore the Custom Instructions for ChatGPT. This resource provides tailored instructions to help you navigate through your financial journey using advanced tools like ChatGPT for personalized advice and insights.

For those looking to elevate their financial understanding, Mastering Digital Product Creation is a noteworthy read, guiding on generating extra money which could be directed towards savings.

Implementing and Expanding Your Financial Planning

Initiating the journey towards financial security necessitates a pragmatic approach to managing your finances. The savings goals worksheet serves as a pivotal tool to navigate this journey effectively.

How to Use a Savings Goals Worksheet

- Identifying Goals: Start by defining what you want to achieve. This could range from short-term goals like saving for a vacation, to long-term goals like retirement savings.

- Setting Target Amounts: Determine the small amount you need to save regularly to meet your goals by the target date.

- Tracking Savings: Regularly update your worksheet to reflect your savings. This keeps you in check and motivates you to continue saving.

- Adjusting Goals: Life is unpredictable. Review your goals at the end of the month and adjust them to align with any changes in your circumstances.

To complement your savings goals worksheet, NerdWallet offers an insightful guide on 5 Steps to Hit Your Savings Goals. Explore this resource for detailed steps and strategies to maximize your savings efforts and achieve your financial objectives.

To get a clear view of your finances, you need a tool that not only organizes your financial goals but also tracks your progress. This is where our Personal Finance Expense Tracker Spreadsheet comes into play.

Our spreadsheet is designed to provide you with a comprehensive view of your financial situation. It enables you to:

Identify Goals: Start by defining your financial goals, whether they are short-term or long-term.

Set Target Amounts: Determine the amount you need to save regularly to meet your goals by specific target dates.

Track Savings: Keep a record of your savings progress, making it easy to stay on course.

Adjust Goals: Life is unpredictable, and financial circumstances change. With our spreadsheet, you can easily adjust your goals to align with your evolving situation.

By using our Personal Finance Expense Tracker Spreadsheet, you’ll have a powerful tool at your fingertips to visualize, plan, and achieve your financial goals effectively.

Frequently Asked Questions (FAQs)

It's crucial to strike a balance between saving and paying down high-interest debts. Consider the following approach:

- Allocate funds to meet minimum payment due dates on all debts to avoid penalties.

- Prioritize paying off your highest interest rates debt like credit cards to reduce total interest paid.

- Set aside a small amount towards your savings goals, even if it's a modest sum, to build a savings habit.

- As you pay down debts, gradually increase your savings contributions.

It's advisable to review your savings goals monthly. Regular reviews will help you:

- Assess your progress towards your goals.

- Make necessary adjustments based on changes in your financial circumstances or priorities.

- Re-evaluate your savings strategies and explore new ways to accelerate your savings.

Prioritizing your savings goals involves a few key steps:

- Establish an emergency fund to cover at least three to six months of living expenses.

- Pay down high-interest debts such as credit card debt or student loans.

- Contribute to retirement savings, taking advantage of employer matching programs if available.

- Allocate funds towards other short-term and long-term goals based on your personal priorities and timelines.

Other Related FAQs

SMART goals provide a structured approach to setting objectives that are Specific, Measurable, Achievable, Relevant, and Time-bound. Applying SMART criteria to your savings goals can enhance clarity, focus, and the likelihood of achieving your financial targets.

Assess your income, expenses, and financial obligations to set achievable savings targets. Utilize budgeting tools and consult with a financial advisor to refine your goals and develop a realistic savings plan.

Various online tools and apps can help track your savings goals. For example, budgeting apps provide an overview of your finances, while online savings goal trackers offer features like goal setting, reminders, and progress visualization within your savings account.

Tracking your progress, celebrating small achievements, and visualizing the benefits of reaching your savings goals can enhance motivation. Engaging with supportive communities, reading financial success stories, and educating yourself on personal finance can also bolster your commitment to saving.

Strategies to accelerate savings include reducing discretionary spending, increasing income through side hustles, automating savings contributions, and taking advantage of employer benefits like 401(k) matching.

Additional Resources

- Financial Blogs and Forums: Engage with communities that share insights and advice on managing savings goals.

- Financial Literacy Courses: Invest in learning to improve your financial life.

- Books on Personal Finance: Books offer in-depth knowledge and strategies for managing your finances.

For those exploring alternative income streams to bolster savings, the guide on How to Make Money Without a Job offers practical tips on generating additional income.