Unveiling the Challenges of Millennial Homeownership in Australia

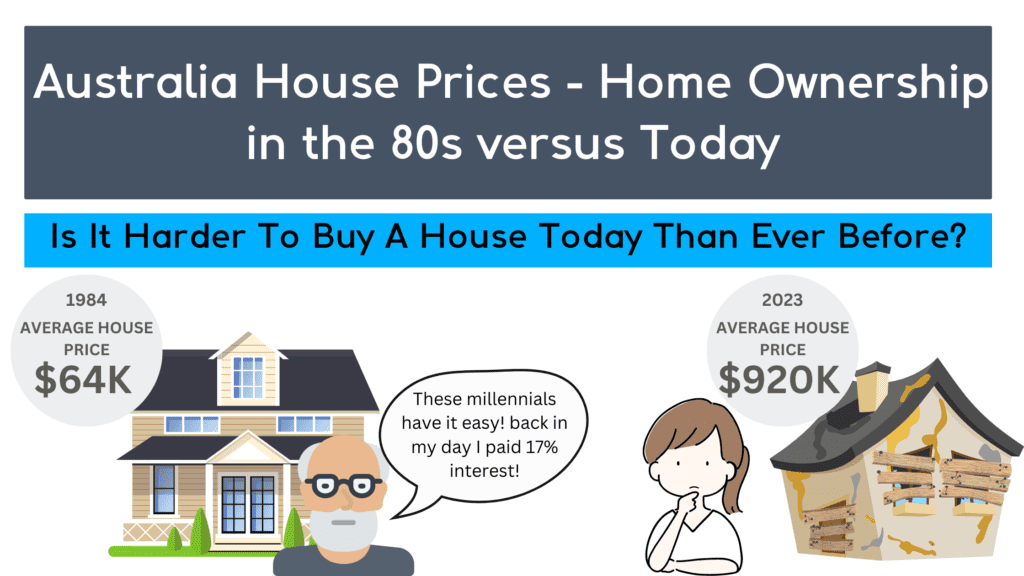

As the Australian dream of homeownership continues to evolve, one question remains constant: How does the current generation’s experience compare to those of the past?

Specifically, how does the journey of millennial homeownership in Australia stack up against the experiences of the baby boomers in the 1980s?

In the 1980s, the Australian housing market was a different landscape. According to Finder.com.au, the average Australian could buy a home that cost just 3.3 times their annual income.

Fast forward to 2023, and the average Australian needs to borrow a staggering 10 times their annual income to secure a home.

This shift in the housing market has sparked a debate: Is homeownership harder for millennials in Australia than it was for previous generations?

This post delves into this question, comparing the cost of homeownership, interest rates, and the overall housing market between these two distinct eras.

The Australian Housing Market: A Historical Perspective

The Australian housing market has seen dramatic changes over the past few decades.

In the 1980s, a period marked by high interest rates, the dream of homeownership was within reach for many Australians.

The average house cost was significantly lower, making it possible for Australian millennial home buyers of that era to step onto the property ladder.

However, the landscape of property ownership for millennials in Australia has shifted dramatically.

Today, despite lower interest rates, the dream of homeownership seems more elusive than ever. The surge in house prices has outpaced income growth, making it increasingly difficult for millennials to break into the Australian real estate market.

As we delve deeper into the housing market for millennials in Australia, it’s essential to understand these historical trends. They provide the context needed to fully appreciate the challenges faced by first-time home buyers in Australia today.

The Cost of Homeownership in the 1980s

In 1984

The average home cost was $64,039.

You borrow, on average $42,277 to buy a house.

Your loan term is 30 years.

Your interest rate is 11.5%.

Your monthly repayments equal $419 (or $5,055 per year)

The average annual income was $19,188.

In the 1980s, the Australian housing market was a different landscape. The average house cost was significantly lower, and the average loan amount was within reach for many Australians.

According to the Australian Bureau of Statistics, the average loan size in November 1984 was approximately $42,000. This figure was manageable for many Australian millennial home buyers of that era, despite the high interest rates that characterized the period.

However, the affordability of homeownership was not without its challenges. The interest rates during this period were notoriously high, with the Reserve Bank of Australia reporting rates as high as 17%. This meant that while the initial cost of buying a property was lower, the cost of servicing a mortgage was significantly higher.

Interestingly, the average home cost in the 1980s was $64,039, while the average annual income was $19,188. This meant that the average mortgage, which was $42,277, was more than double the annual income. Despite the high interest rates, the lower property prices made homeownership a realistic goal for many Australians during this period.

The landscape of property ownership for millennials in Australia was markedly different in the 1980s, but it laid the groundwork for the trends we see today.

The high interest rates of the past have given way to skyrocketing property prices, shifting the challenges faced by first-time home buyers in Australia.

The Cost of Homeownership Today: A Millennial's Perspective

Today

The average home costs $920,100.

You borrow, on average $618,722 to buy a house.

Your loan term is 30 years.

Your interest rate is 6%.

Your monthly repayments equal $3,710 (or $44,949 per year)

The average annual income is $90,896.

When comparing millennial homeownership in Australia today with the situation in the 1980s, one significant aspect to consider is the average loan amounts taken by first-time home buyers. In the 1980s, first-time home buyers in Australia typically took out loans with an average amount of $42,277 to purchase their homes.

Fast forward to the present day, and we find that millennial home buyers in Australia are facing higher average loan amounts compared to their counterparts in the 1980s.

According to Finder.com.au, the average loan amount for first-time home buyers has increased to $576,985. This figure is more than six times the average annual income of Australians today, which stands at $90,896.

Moreover, the average home cost in 2023 is $920,100, a staggering increase from the 1980s. This sharp rise in property prices, coupled with the increase in average loan amounts ($618,722), has made the dream of homeownership a challenging goal for many Australian millennials.

The rising average loan amounts have created a significant barrier for millennial home buyers in Australia, making it increasingly challenging for them to achieve their dream of homeownership. The burden of higher loan amounts can lead to financial strain, limited housing options, and a longer path to paying off their mortgage.

Understanding the impact of average loan amounts on millennial homeownership in Australia is crucial for policymakers and individuals alike. In the next section, we will explore the factors contributing to these higher loan amounts and discuss potential solutions to make homeownership more accessible for millennials.

Interest Rates: Then and Now

Interest rates play a crucial role in the affordability of homeownership. In the 1980s, Australia experienced a period of high interest rates, with the Reserve Bank of Australia reporting rates as high as 17% in 1990. In November 1984, variable interest rates were at 11.5%, which was already considered high. This high-interest environment significantly impacted the cost of servicing a mortgage, despite the lower property prices at the time.

Fast forward to today, and the situation is quite different. Interest rates have seen a significant decrease. After being at their lowest point in history, interest rates are now rising, but you can still get a home loan rate for around 6%. This lower interest environment has made mortgage repayments more manageable for Australian millennial home buyers. However, the high property prices have offset the benefits of these lower interest rates.

For first-time home buyers in Australia, the lower interest rates can be both a blessing and a curse. On one hand, it makes the cost of borrowing cheaper, making it easier to service a mortgage. On the other hand, it has contributed to the surge in property prices, making it harder for millennials to enter the housing market.

The Impact of Interest Rates and Potential Solutions

Interest rates significantly influence the affordability of homeownership, particularly for millennial home buyers in Australia. The historically low interest rates in recent years have made borrowing more affordable, leading to increased demand for housing and rising property prices. This surge in property prices, however, has made it more challenging for millennials, especially first-time home buyers, to enter the housing market.

Government initiatives aimed at supporting first-time home buyers, such as the First Home Super Saver Scheme (FHSS) have been introduced to assist millennials in overcoming the financial barriers associated with purchasing their first home. These programs are crucial in the current Australian housing market, where the low-interest environment has contributed to skyrocketing property prices.

Financial literacy and education also play a vital role in millennial homeownership in Australia.

Understanding the complexities of the housing market, including mortgage rates, loan terms, and repayment options, can empower millennials to make informed decisions and navigate the homeownership process more effectively.

This knowledge is particularly important for first-time residential buyers in Australia, who may find the process of purchasing a home daunting.

Alternative homeownership models could also be explored to address the affordability issue. Concepts like shared ownership, rent-to-own programs, or cooperative housing can provide millennials with more flexible and affordable pathways to homeownership. These innovative models could potentially reshape Australia’s new homeowner market, making homeownership more accessible for millennials.

In summary, while interest rates play a significant role in determining the affordability of homeownership for millennials in Australia, they are not the only factor. A multi-faceted approach involving government support, financial education, and innovative homeownership models is needed to make homeownership more accessible for this generation.

Conclusion: Addressing the Challenges of Millennial Homeownership in Australia

The dream of homeownership remains elusive for many millennials in Australia.

Rising property prices, stagnant wages, and stricter lending criteria have created a challenging environment for young Australians looking to enter the property market, much more so than it was for young Australians in 1984. This situation has significant implications for their financial stability and long-term wealth accumulation.

Addressing the barriers to homeownership for millennials in Australia is of utmost importance. The potential consequences of a generation unable to enter the property market could include widening wealth inequality and reduced economic mobility. This issue is particularly relevant for first-time home buyers in Australia, who are finding it increasingly difficult to take that first step onto the property ladder.

There are potential solutions and policy measures that could help improve millennial homeownership rates in Australia. Initiatives like government assistance programs, increasing the supply of affordable housing, and addressing the issue of stagnant wages could have a positive impact on the housing market. These measures could make homeownership more accessible for first-time buyers and help alleviate some of the financial pressures faced by millennials.

While there are no quick fixes to the challenges faced by millennials in the housing market, the barriers to millennial homeownership in Australia are not insurmountable. With concerted effort and innovative solutions, it is possible to create a more inclusive and accessible housing market for all Australians.

Frequently Asked Questions (FAQs)

Many first-time home buyers and millennials have questions about the challenges they face in the current Australian housing market. Here are some common queries:

Why is homeownership harder for millennials in Australia compared to the 1980s?

What were the average home cost, annual income, and mortgage in 1984?

What are the average home cost, annual income, and mortgage in 2023?

What are the options available for first-time home buyers in Australia?

How can millennials save for a deposit in the current housing market?

Are there any alternative homeownership options for millennials?

What should millennials consider before buying their first home?

The information in this blog post has been gathered from a variety of reliable sources to provide a comprehensive view of the challenges and opportunities for millennial homeownership in Australia. Here are the sources we’ve used:

- Australian Bureau of Statistics (ABS) – Housing finance for owner occupation, Australia November 1984

- Australian Bureau of Statistics (ABS) – Average weekly earnings, Australia 2021

- Australian Bureau of Statistics (ABS) – Residential Property Price Indexes: Eight Capital Cities

- Reserve Bank of Australia (RBA) – Indicator Lending Rates

- Finder – Owning a home in the 80s vs today

These sources provide valuable insights into the housing market trends, economic factors, and government initiatives that impact homeownership in Australia. They offer a wealth of data and analysis that can help prospective homeowners navigate the complexities of the Australian housing market.