Hi everyone,

As a recent graduate myself who has to pay off HECS debt in excess of $60,000, the recent news about the 2023 indexation rate that will be applied to student HECS-HELP loans has my full attention.

That’s why I felt obliged to write a post about this topic.

The recent announcement that the indexation rate for HECS debt in 2023 will be 7.1%, one of the highest in decades, has left many Australian students and graduates feeling concerned and overwhelmed.

Trust me, I’m in the same boat so I fully understand the pressures we are all feeling right now.

But as you navigate this crucial financial decision, this comprehensive guide aims to ease your worries and provide you with the essential knowledge to make informed choices about whether or not you need to pay off your HECS debt in 2023.

I promise that after reading this post, you will feel a lot less stressed and anxious about the recent news.

So let’s go.

The Basics of HECS-HELP Debt in Australia

The Higher Education Loan Program (HELP), often referred to as ‘HECS-HELP debt’, functions as an educational tax that students gradually repay.

HECS-HELP loans are designed to assist eligible students attending approved higher education institutions by covering their tuition fees.

These loans are unique in that they don’t accrue interest like traditional loans. Instead, they are subject to annual indexation to adjust for inflation.

For 2023, the indexation rate is 7.1%, a significant increase that has taken many Australians by surprise.

Repayments for your HECS-HELP debt are income-contingent, meaning they are calculated based on your earnings.

Once your income surpasses the minimum repayment threshold ($48,361), you can opt for your employer to automatically deduct repayments from your salary through the pay-as-you-go (PAYG) withholding system, similar to income tax payments (eg, the tax paid on your base salary).

Your HECS debt repayment amount is determined by your income, with specific thresholds indicating when repayments commence and the corresponding percentage rate.

For many individuals, the amount withheld from their salary each year will exceed the indexed amount, meaning you won’t have to pay anything out of pocket come tax time.

Keep in mind that these thresholds may fluctuate depending on the government’s policies.

One of the key distinctions of HECS debt is that it does not accrue interest like credit debt. Instead, the Australian Taxation Office (ATO) applies an annual indexation based on the previous two years’ Consumer Price Index (CPI) data. This process takes place on June 1 each year, affecting debts older than 11 months. By using an averaged indexation rate, the system tries to achieve fairness and consistency in inflation adjustments.

So although the 2023 7.1% indexation rate seems (and is) extremely high, it would be even larger if the average of the past two years wasn’t considered.

In light of the significant indexation rate increase in 2023, this guide aims to help you understand the intricacies of the HECS-HELP loan system, effective repayment strategies, and potential implications for mortgage applications, enabling you to make the best decision for your financial future.

Key Terms to Master the HECS-HELP Loan System

To confidently navigate the process of paying off HECS debt, it’s important to understand the key terms related to the HECS-HELP loan system.

So let’s look at some of the most important terms you need to be aware of, ensuring you’re well-equipped to make informed decisions about your debt repayment in 2023.

Compulsory repayment: Compulsory repayment refers to the amount withheld from your salary and wages throughout the year. It’s applied to your HELP debt after you complete your tax return. If you’re self-employed as a sole trader, you’ll need to set aside a repayment amount, as you’ll owe the money upon completing your first tax return.

Voluntary repayment: A voluntary repayment is an additional payment you choose to make towards paying off HECS debt, above the compulsory repayment amount. Be careful here, because even if you make a voluntary repayment, you still have to pay the compulsory repayment amount! That’s even if you make a voluntary payment that is higher than your compulsory repayment amount!

Repayment income thresholds: These thresholds determine the amount you’re required to pay towards your HELP debt based on your income. As your income increases, so does the repayment percentage.

Indexation: Indexation refers to the annual adjustment applied to your HELP debt on June 1 each year. This adjustment is based on the previous two years’ Consumer Price Index (CPI) data and affects debts older than 11 months.

CPI (Consumer Price Index): CPI is a measure of the increasing costs of goods and services in an economy, tracked quarterly by the Australian Bureau of Statistics (ABS). It plays a significant role in determining the indexation rate for HELP debts.

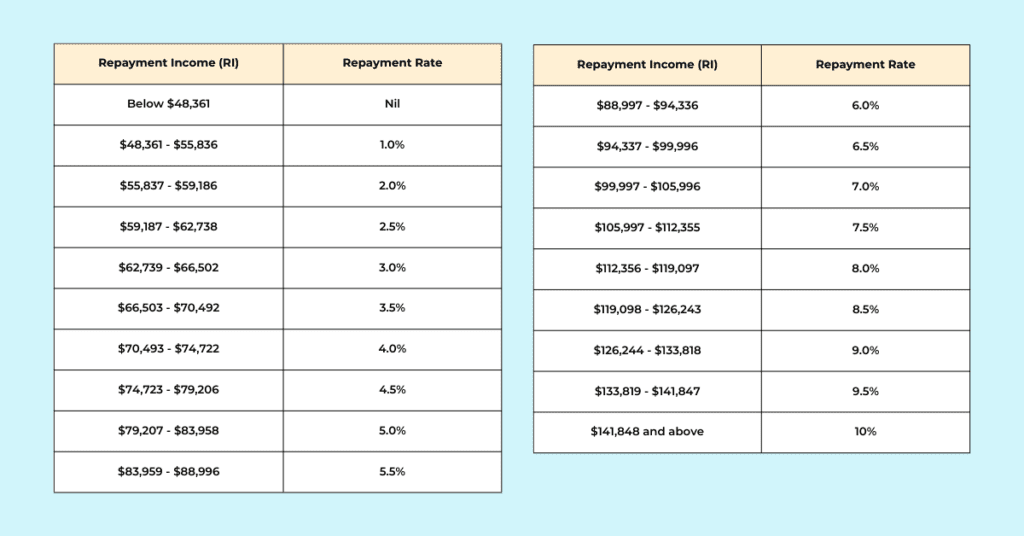

Repayment Income Thresholds for 2023

Before we go on further, let’s have a look at the repayment income thresholds so you know what your repayment obligations are.

Below, you’ll find a table outlining the repayment income thresholds and corresponding repayment rates for the 2023 financial year:

For example, if you earn $75,000, you would multiply $75,000 by 0.045 (4.5%), which equals $3,375.

That means that in 2023, your repayment amount for paying off HECS will be $3,375.

Remember, it doesn’t matter what the value of your HECS debt is, the threshold is purely dependent upon how much you earn!

Another important thing to note is that in determining your withholding percentage for HECS-HELP debt repayments, it’s crucial to understand that it’s based on your repayment income, not just your overall income.

This distinction is often misunderstood, leading to surprises when individuals complete their tax returns.

At the end of the financial year, the Australian Taxation Office (ATO) reconciles your repayment income. If your employer has withheld too much for your HELP repayment, you’ll receive a refund.

However, if not enough has been withheld, you may face an additional tax bill.

Repayment income consists of your taxable income, plus any total net investment loss (including net rental losses), total reportable fringe benefits amounts, reportable super contributions, and exempt foreign employment income. We’ll discuss a bit more about this in the next section.

By comprehending this definition, you can better prepare for paying off your HECS debt in 2023 and avoid unexpected tax liabilities.

Salary Sacrifice and HECS Debt: Avoiding Extra Tax Bills

There are potential pitfalls when it comes to salary sacrifice contributions, either to superannuation or through salary packaging arrangements, that can result in unexpected tax bills at the end of the year.

Let me make an important distinction here though – this does not mean that salary sacrificing is not a good idea.

Salary sacrificing additional income can have incredibly powerful results for your long term retirement fund, which I’ve described in great detail here.

But just be aware that it can cause surprises to your HECS tax bill if you don’t understand how your income is assessed by the ATO!

To avoid these surprises and effectively manage your HECS-HELP debt repayments, consider the following options:

Request that your employer withholds an additional amount each week to cover the compulsory repayment due. This approach ensures that you’re on track with your repayments and less likely to face a lump sum payment at tax time.

If you prefer not to have additional withholdings, understand that you’ll need to save the necessary amount yourself and be prepared to pay the lump sum when your tax is lodged.

For example, if you earn $80,000 but decide to salary sacrifice $15,000 to your superannuation (above your employer’s super contribution), your employer would only assess $65,000 as your withholding income ($80,000 minus the $15,000 that you salary sacrificed).

This means that they would only withhold 3.0% of your income (your repayment rate would be assessed in the $62,739 – $66,502 repayment income band, which is 3.0%).

That means your employer would only withhold $1950 (3.0% of $65,000).

However the ATO assesses your repayment income as $65,000 PLUS the $15,000 you sacrificed into super, so they would charge you a repayment amount of $80,000 multiplied by 5.0% (matching the $79,207 – $83,958 repayment income band), which comes outs to be $4,000.

So if you relied only on what your employer was withholding to meet your compulsory repayment, you would be $1,950 short.

This means, when you do your taxes, you would have to pay a $1,950 tax bill to meet your compulsory repayment amount.

That’s why asking your employer to withhold additional income can prevent this from happening if you are making additional salary sacrifice arrangements.

This scenario applies regardless of your income tax or take-home pay due to strategies like salary sacrifice to super or other reportable fringe benefits (e.g., cars) and salary packaging arrangements (e.g., meal cards).

It’s crucial to be aware of your total liability and plan for it each year, ensuring you’re well-prepared to pay off your HECS debt in 2023.

Understanding the HECS-HELP Debt Timeline

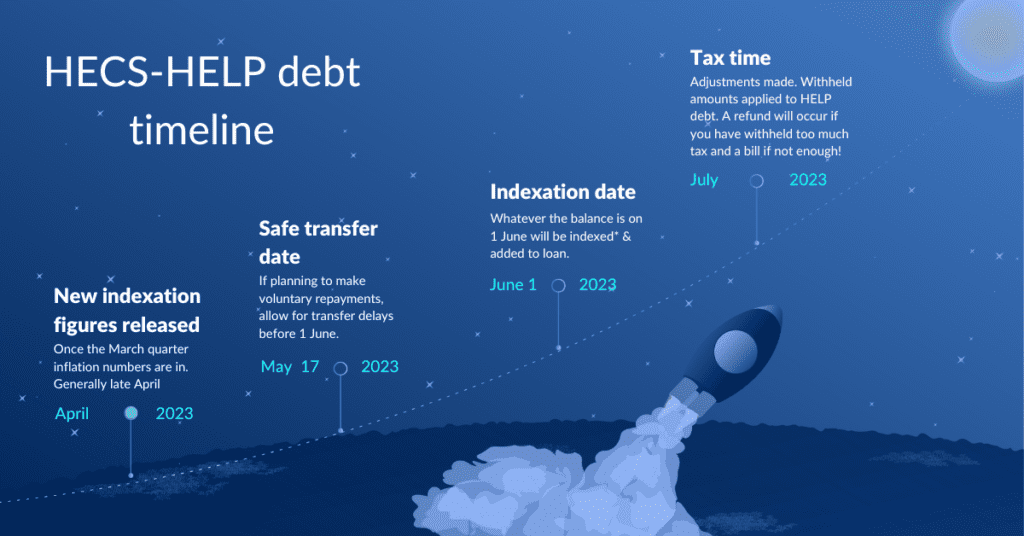

Understanding the critical dates in the HECS-HELP debt timeline can help you better manage your debt and make strategic decisions about paying it off in 2023. The following are essential dates to keep in mind:

- April: New indexation figures are released by the Australian Taxation Office (ATO), providing information on the percentage increase in your HELP debt due to inflation.

- May 17: The safe transfer date represents the time you should try and make sure you have made any voluntary repayments by. This is to avoid your payment not being processed by June 1st. By making a payment on or before this date, you can reduce the amount of your HELP debt subject to indexation.

- June 1: The indexation date is when the ATO applies the indexation amount to your HELP debt that is more than 11 months old. This date is critical for calculating your updated debt balance for the next financial year.

- July: Tax time is when you’ll need to lodge your tax return, and the ATO will assess your repayment income to determine your compulsory repayment obligations for your HECS-HELP debt.

Making Voluntary Payments Towards Your HECS-HELP Debt

Voluntary payments can be an effective way to reduce your HECS-HELP debt faster, but it’s essential to understand the process and consider other financial priorities before making additional payments.

You can make voluntary payments through your bank account, BPAY, or credit card.

However, keep in mind that voluntary repayments do not reduce your compulsory repayments unless you pay off your entire debt. This fact can lead to unexpected repayment obligations, so be prepared for that possibility.

Before making voluntary payments towards your HECS-HELP debt, consider the following financial milestones:

- Ensure your emergency fund is complete.

- Pay off all consumer debt (credit cards, personal loans, buy-now-pay-later).

- Secure a house deposit if homeownership is a goal.

- Establish a stable career or business.

- Achieve other short-term financial goals.

It’s also crucial to consider how your HECS-HELP debt may impact your ability to obtain a mortgage. In some cases, mortgage brokers may recommend clearing your HELP debt before applying for a home loan if you only have a few thousand dollars left to pay off. Always consult with a broker before making voluntary repayments if you plan to secure a mortgage in the near future.

By taking a strategic approach to voluntary payments, you can effectively manage your HECS-HELP debt while balancing other financial priorities and goals, ultimately helping you pay off your debt in 2023.

Understanding the Impact of HECS-HELP Debt on Mortgage Borrowing Capacity

A prevalent concern for many Australians is the potential influence of their HECS-HELP debt on their mortgage borrowing capacity. While it’s true that HELP debt can affect your ability to borrow, it’s essential to approach the situation with a clear understanding and a positive mindset, knowing that your HECS debt doesn’t necessarily hinder your homeownership dreams.

When applying for a mortgage, lenders consider your HELP debt in terms of serviceability, which focuses on your repayment rate rather than the total debt amount. For instance, if you have a $100,000 HELP debt but earn below the repayment threshold, your borrowing capacity remains unaffected, as lenders base their calculations on your actual repayments.

In many cases, first-time homebuyers find that their deposit size, rather than their serviceability, limits their desired purchase price. Therefore, it’s crucial to consult a mortgage broker to assess your personal situation before taking any significant steps, such as using your cash reserves to pay off your HELP debt. Keep in mind that once you allocate funds towards your HELP balance, they cannot be retrieved.

A competent mortgage broker can evaluate your borrowing capacity with and without your HELP debt, enabling you to make well-informed decisions about your financial future. So, don’t let the fear of HECS-HELP debt hold you back from pursuing your dream of homeownership. Approach the situation with confidence and a proactive plan, and you’ll find the right balance between managing your debt and securing the mortgage you desire.

Comparing Large and Small HECS-HELP Debts in Mortgage Borrowing

A common misconception is that the size of your HECS-HELP debt will have a significant impact on your ability to borrow for a home. However, when it comes to mortgage applications, the amount of your HECS debt is not as crucial as your repayment rate.

Whether you have a sizable HECS-HELP debt of $745,249 or a smaller one of $6,600, the treatment by mortgage lenders remains the same. They focus on your repayment rate, which is based on your income, rather than the total debt amount. As long as you’re meeting the repayment threshold, the actual size of your debt has little bearing on your borrowing capacity.

This understanding can be quite reassuring for those who might feel overwhelmed by their HECS-HELP debt.

It’s essential to recognize that having a large or small HELP debt doesn’t necessarily hinder your ability to secure a mortgage.

Instead, focus on maintaining a stable income, meeting the repayment threshold, and working closely with a mortgage broker to navigate your financial options and make well-informed decisions.

The Implications of HECS Debt on Your Estate and Loved Ones

An often overlooked aspect of HECS-HELP debt is its impact on your estate in the event of your passing. It’s essential to consider how your decision to pay off your HECS debt could affect your loved ones, especially if you have dependents such as a family or children.

When you pass away, any remaining HECS-HELP debt is cancelled, and it does not become a liability for your estate or loved ones. However, this also means that any voluntary payments you’ve made towards your HECS debt are non-refundable and won’t be accessible by your loved ones.

For instance, if you were to make a $20,000 payment towards your HECS debt and then pass away the next day, that $20,000 would not be available for your loved ones to inherit. On the other hand, if you had instead invested that $20,000, it would become part of your estate and be accessible to your beneficiaries.

Given these implications, it’s crucial to carefully weigh your options before making any lump-sum payments towards your HECS-HELP debt. Depending on your personal circumstances and priorities, it may be more beneficial for you and your loved ones to invest or allocate the funds elsewhere, rather than paying off your HELP debt early.

Always consider the long-term consequences of your financial decisions and consult with a financial advisor or estate planner to ensure the best outcome for you and your loved ones.

Frequently Asked Questions (FAQs) About Paying Off HECS Debt

Salary sacrificing HELP repayments through your workplace salary packaging are considered voluntary repayments. You will still need to make compulsory repayments based on your total repayment income.

If you pass away with outstanding HECS-HELP debt, the debt will be cancelled and will not be transferred to your loved ones. This is why it’s worth considering investing any extra money into investments, superannuation, or mortgage repayments, rather than making voluntary repayments towards your HECS-HELP debt.

You must still declare your overseas income to the Australian Taxation Office (ATO) and continue to do a tax return while living abroad. This means you will need to keep making compulsory repayments on your HECS-HELP debt while overseas.

HECS-HELP debt does not directly impact your credit score. However, it can affect your ability to obtain loans or credit, as lenders may consider your compulsory repayments when assessing your loan serviceability.

No, voluntary HECS-HELP repayments are not tax-deductible. Compulsory repayments are made through the tax system and are also not tax-deductible.

You can view your HECS-HELP debt balance by logging into your myGov account and accessing the ATO’s online services. Your balance will be updated annually after you lodge your tax return.

Should You Pay Off Your HECS in 2023?

So with all that information, you’re probably still asking “so should I pay off HECS in 2023?”

Unfortunately the answer to this question is not black and white.

It is a challenging decision, but ultimately, it is a personal choice based on your financial goals and circumstances.

While the indexation rate of 7.1% in 2023 has been a shock to us all, history has shown us that high indexation rates like this are not expected to be a frequent occurrence.

I mean, just look at the list of some historical indexation rates. You can find some peace in knowing that 7.1% is not the norm:

- 2012: 3.0%

- 2013: 2.9%

- 2014: 2.6%

- 2015: 2.1%

- 2016: 1.5%

- 2017: 1.9%

- 2018: 1.9%

- 2019: 1.8%

- 2020: 1.8%

- 2021: 0.6%

But remember, It’s crucial to understand that you don’t have to sacrifice other financial goals, such as saving for a house, in order to aggressively pay off your HECS debt.

There are many other important financial milestones you can focus on, while your HECS debt is gradually reduced through compulsory minimum repayments.

Consider instead these points when deciding whether to pay off HECS in 2023:

- Assess your financial priorities: Consider your short-term and long-term financial goals and determine where paying off your HECS fits within these priorities.

- Evaluate your current financial situation: Look at your income, expenses, savings, and investments to determine whether you have the resources to pay off your HECS without compromising other goals.

- Consider the impact on your overall financial health: Determine if paying off your HECS in 2023 will provide you with a sense of financial security and peace of mind, or if it might be more beneficial to allocate those funds towards other financial objectives.

Ultimately, the decision to pay off your HECS in 2023 should be based on your unique financial situation and goals.

It’s essential to weigh the pros and cons and seek professional advice if needed.

Remember, you don’t need to stress about your HECS debt; with the right approach and a clear understanding of your priorities, you can successfully manage your debt while still working towards your financial dreams.

Final Thoughts on Managing Your HECS-HELP Debt

As we’ve discussed throughout this guide, managing your HECS-HELP debt is a crucial aspect of your financial life.

By understanding the implications of your debt, repayment options, and the effect it can have on your financial goals, you can make informed decisions that best serve your needs.

I hope this post has helped alleviate some of your concerns. Although it does suck that we are facing such a large indexation of 7.1% this year, understanding that it doesn’t actually change our repayment obligations can be helpful, or at least reduce our anxiety.

So before we conclude, remember to consider the following key points:

- Stay informed about the indexation rate, as this will affect the overall amount of your HECS-HELP debt.

- Be aware of your compulsory repayment obligations and ensure your employer is withholding the correct amount.

- Evaluate your personal financial situation before making voluntary repayments or prioritizing other financial goals.

- Don’t let your HECS-HELP debt discourage you from pursuing homeownership, as it may not significantly impact your borrowing capacity.

- Consult a financial advisor or mortgage broker for personalized advice before making significant financial decisions related to your HECS-HELP debt.

Last of all, if you have any questions or comments, I’d love to hear them!