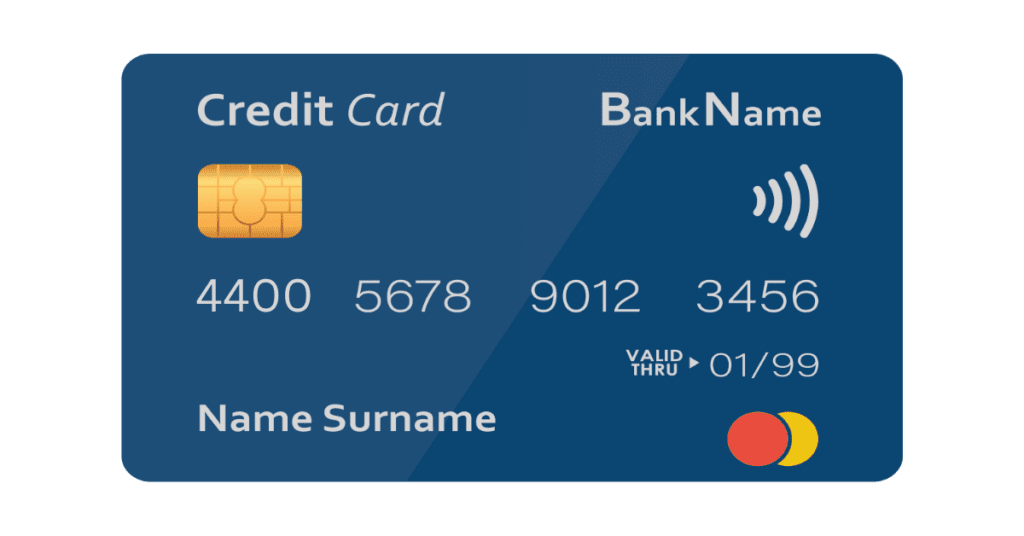

Delve into the enigmatic world of credit card numbers as we unravel the significance behind the 4400 series. From the banking institutions behind these cards to the Visa network they often belong to, we decode what these four initial digits disclose about your card.

Unveiling the mystery behind the first four digits of a credit card number often leads to a maze of significant information. These digits are not just arbitrary numbers, but a gateway to understanding the financial institution, the card’s origin, and its type. Here’s a brief on what these digits entail:

If you’re an Australian currently looking for a new visa/debit card, then the following savings accounts might be perfect for you. You will receive a free Visa/debit card if you open up an account with either of them (plus you can bank a bonus $120 worth of cash for free).

ING HYSA – 5.5% Interest Rate + Free $100 Sign-up Bonus

ubank HYSA – 5.5% Interest Rate + $20 sign-up bonus

Understanding the Significance of Credit Card Digits

The anatomy of a credit card number unveils a systematic approach towards ensuring security and providing essential information. Here’s a breakdown:

- Type of Card: The initial digits indicate the type of card—whether it’s a credit, debit, or a prepaid card.

- Issuer Identification: The BIN or IIN helps in identifying the issuing institution. BIN databases provide a platform for this verification.

- Luhn Algorithm: The arrangement of digits adheres to the Luhn Algorithm, ensuring a valid card number.

- Unique Identification: Each card holds a unique string of numbers facilitating secure transactions.

Identifying the 4400 Series

Credit cards commencing with 4400 unfold a particular identity, belonging to the Visa network. Here are the specifics:

- Visa Network: The initial digit ‘4’ categorizes these cards under the Visa network, indicating a well-established global network.

- Card Issuers: Various financial institutions issue these cards, each having a unique set of BIN.

- Type of Visa Cards: The series indicates the type of Visa card, whether it’s a credit or debit card type. Resources like the Visa’s Official Website provide detailed information on the same.

The Issuers Behind 4400 Credit Cards

Diving into the issuers of the 4400 series cards unveils a gamut of banks and financial entities. Here’s a glimpse:

- Issuing Institutions: Entities like Bank of America and credit unions are among the issuers of this financial product.

- Business Banking: These cards are often aligned with business banking services, facilitating a range of financial transactions.

- Online Transactions: The 4400 series cards are adept for online transactions, thanks to the secure BIN and primary account number.

Differentiating Between Visa Card Types

The 4400 series is a fragment of the vast Visa network, which encompasses a variety of card types. Here’s a differentiation:

- Credit & Debit Cards: Understanding the difference between Visa credit and debit cards is crucial for cardholders.

- Card Details: The credit card details are embedded within the credit card or debit card number, facilitating a secure transaction environment.

- Major Credit Card Networks: Visa is among the major credit card networks globally, offering a plethora of card options.

FAQs

Addressing common queries provides a clearer understanding of the credit card digit system. Here are some frequently asked questions:

The initial four digits on a credit card, also known as the Bank Identification Number (BIN) or Issuer Identification Number (IIN), signify the financial institution that issued the card. These digits help in identifying the brand of the card (e.g., Visa, Mastercard), the issuing bank, and the card type.

The 4400 series of credit cards are issued by various banks and financial institutions, including Bank of America, U.S. Bank, the First National Bank of Omaha, and FIA Card Services, among others.

The 4400 series encompasses a variety of card types including Visa Classic, Visa Gold, Visa Platinum, Visa Signature, and Visa Business debit and credit cards.

No, all Visa cards have a 3-digit CVV (Card Verification Value) number. American Express cards are the only ones that use a four-digit CVV number.

Visa debit cards have a 3-digit security code located on the back of the card, usually next to or above the signature block.

Every Visa card starts with the digit 4. Since only the Visa network uses 4 as the first digit, every card with a four as the first number is a Visa card.

Visa cards start with a 4, Mastercards start with a 2 or a 5, and Discover cards start with a 6. Diner’s Club, Carte Blanche, JCB, and American Express card numbers start with a 3.

The first 6 digits of a credit card are called an Issuer Identification Number (IIN), which is also known as a Bank Identification Number (BIN). The IIN/BIN is used to determine the bank or financial institution that issued the card.

The first four digits of a credit card can provide information about the issuing financial institution, but may not directly indicate the country of issuance. However, the first digit, known as the Major Industry Identifier (MII), can provide some geographical or institutional information.

Yes, both debit and credit cards use the first four digits as the Bank Identification Number (BIN) or Issuer Identification Number (IIN) to identify the issuing financial institution and the card type.

The Bank Identification Number (BIN) is crucial as it identifies the issuing institution of the card. It helps in the authorization, clearance, and settlement of transactions, ensuring that the charges are sent to the correct bank for processing.

The Luhn Algorithm is a mathematical formula used to validate a variety of identification numbers, including credit card numbers. It checks the arrangement of the digits to ascertain whether a card number is valid or not based on a specific calculation. This helps in minimizing the errors in data entry and ensuring the authenticity of the transaction.

The first digit of a credit card number, known as the Major Industry Identifier (MII), indicates the industry sector of the issuing institution. For instance, a '4' or '5' as the first digit represents the banking and financial sector, indicating a Visa or MasterCard respectively.

One can verify the issuing bank using the card number by referencing the Bank Identification Number (BIN). Various online tools and BIN checkers provide this service, enabling individuals to look up the issuing institution and other details related to the card.

Several security measures are embedded in the credit card information to prevent fraud and unauthorized access. These include the card verification value (CVV), encrypted chips, and sometimes additional personal identification number (PIN) verification for transactions. Moreover, the structure of the card number itself, validated by the Luhn Algorithm, acts as a security measure to detect any unauthorized or incorrect card number entries.

Delving Deeper

As we unravel the intricacies of the 4400 series cards, it’s pivotal to dive into the safety protocols, financial management, and the evolution of online transactions associated with these cards. The journey from understanding the digits to navigating the digital realm is enlightening, ensuring cardholders are well-versed with their cards’ capabilities.

Safety Measures for 4400 Series Cardholders

Ensuring the security of credit card information is paramount in the contemporary digital era. Here are some security facets associated with 4400 series cards:

- Encryption: The credit card details are encrypted to prevent unauthorized access and credit card fraud.

- Secure Online Purchases: These cards facilitate online purchase transactions securely, ensuring data integrity.

- Contactless Payment: The feature of contactless payment expedites transactions while maintaining high security standards.

- Security Policies: Adherence to robust security policies by the issuing banks guarantees a secure transaction environment.

Financial Management for 4400 Series Cardholders

Prudent financial management is crucial for optimizing the benefits of your card. Here are some tips:

- Credit Limit Management: Being cognizant of your credit limit and managing it effectively helps in maintaining a good credit score.

- Monthly Payments: Timely monthly payments towards the card balance ensure you avoid any extra charges or fees.

- Financial Advisory: Consulting a financial advisor for tailored advice on managing your card can be beneficial.

- Investment Opportunities: Explore investment products to grow your savings and manage investment risk.

Federal Trade Commission’s (FTC) Guide on Credit Card Fraud provides comprehensive insights on safeguarding your financial resources.

Navigating Online Transactions with 4400 Series Cards

The 4400 series cards are well-equipped for the digital realm. Here’s how they fare:

- Ease of Transactions: Making an online purchase or executing online transactions is simplified with intuitive interfaces.

- Secure Payments: Each online transaction is secured with multiple layers of verification, minimizing the risk of credit card fraud.

- Contactless Payments: The contactless payment feature further eases the process, making it swift and secure.

A Glimpse into the Future of Credit Card Identification

The landscape of credit card identification systems is continually evolving. Some insights into the future include:

- Enhanced Security: With advancements in technology, credit card information will be safeguarded with even more robust encryption techniques.

- Seamless Transactions: The transition to online transactions will become more seamless with enhanced card verification value (CVV) systems.

Conclusion

The expedition from unraveling the mystery behind the first four digits of a credit card to understanding the various facets of financial management and online security has been enlightening. The 4400 series cards, predominantly issued by Visa, embody a blend of security, convenience, and financial management, reflecting the robust framework established by financial institutions. The bank identification number (BIN) and issuer identification number (IIN) play a pivotal role in this framework, bridging the physical and digital realms of financial transactions. With the continual evolution of credit card identification systems, cardholders are poised to experience even more secure and streamlined financial interactions.

As we tread on the path of financial literacy, understanding the impact of high-interest debts, especially those accrued on credit cards, becomes crucial. The information encoded in your credit card number not only identifies the issuing institution but also underlines the importance of managing credit wisely. Before venturing into the realm of investing, ensuring a clean slate by clearing off high-interest debts is imperative. Dive deeper into this discussion and explore the factors to consider before you embark on your investment journey in our post on Things to Consider Before You Start Investing.